ON YOUR MIND

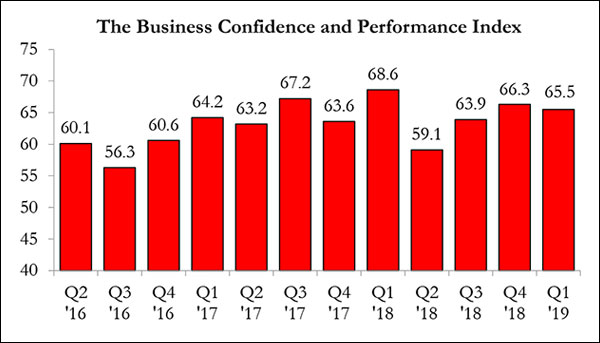

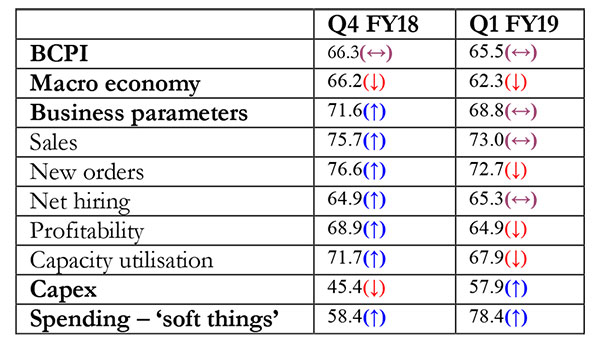

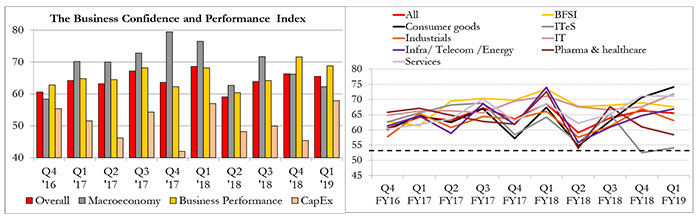

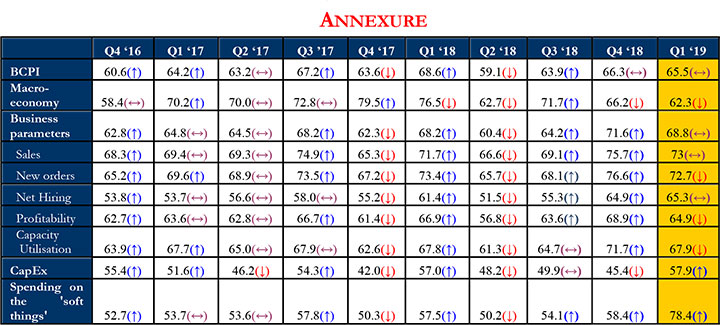

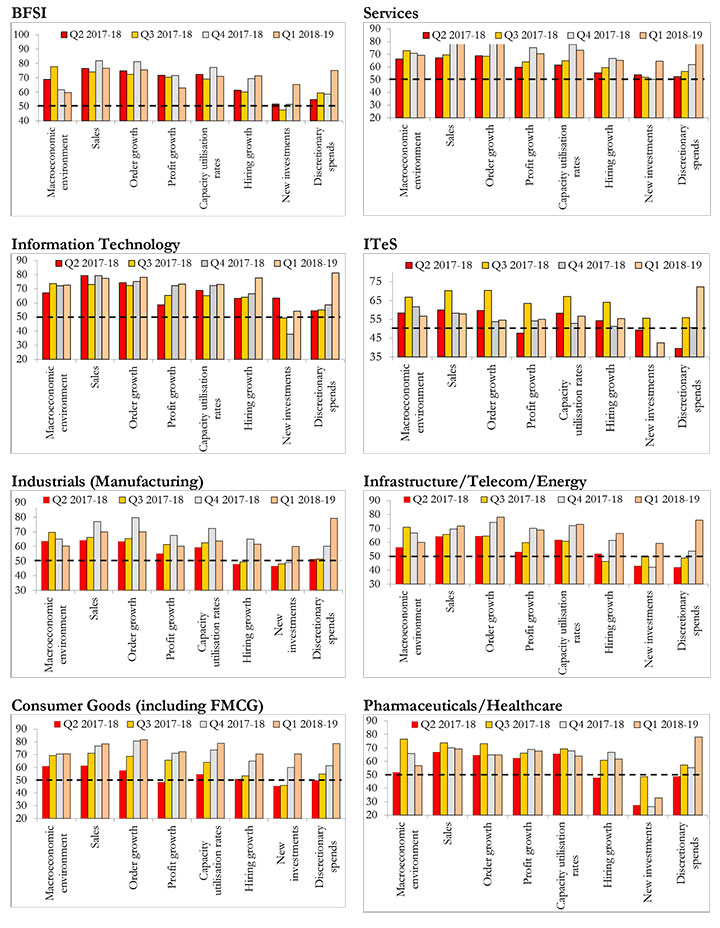

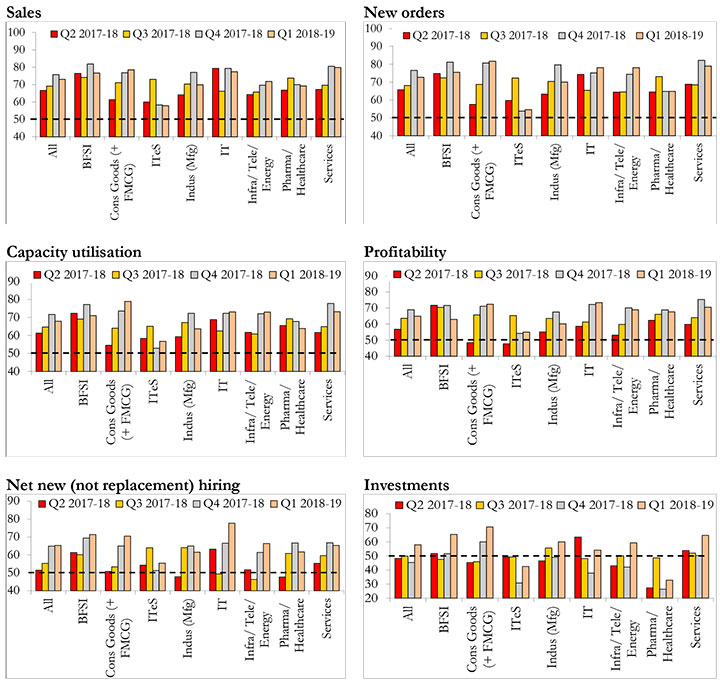

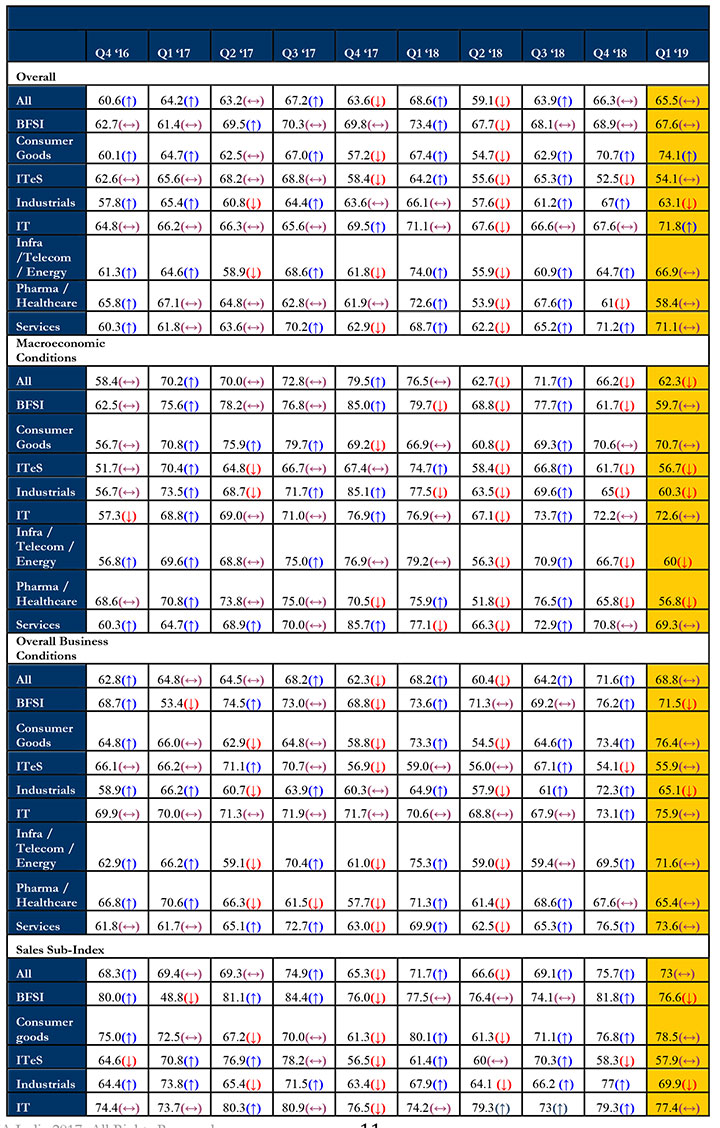

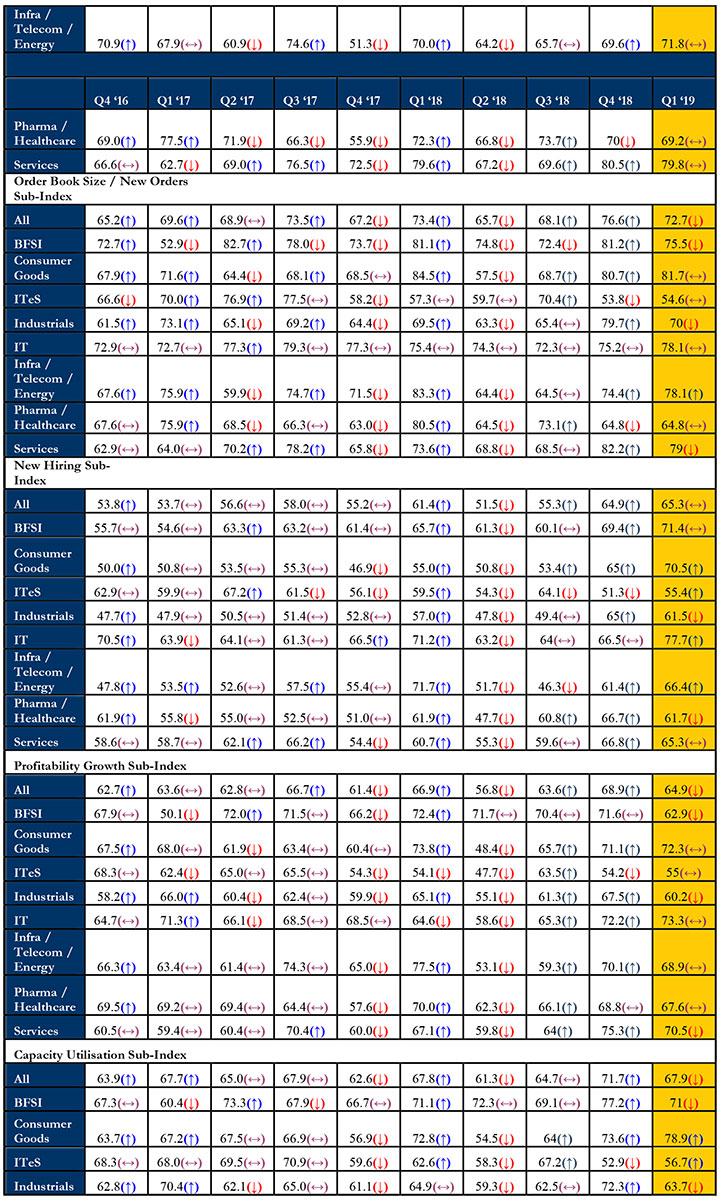

India’s GDP growth accelerated to 7.7% in the last quarter of 2017-18, taking FY 2017-18 growth to 6.7%, a tad higher than estimates of India’s Central Statistical Organisation. IMA’s bellwether quarterly business confidence and performance index (BCPI) has reflected this acceleration since the middle of the October-December quarter in 2017, moving back into the 60+ range and with expectations of higher growth in subsequent quarters. With over 280 member company respondents in end-May/early-June, the BCPI currently stands at a very respectable 65.5, driven by expectations of better business performance – the sub-index for performance is close to 70, with the sales and new order indices at even higher levels of 73.

IMA’s Forums are less upbeat about the macro-economy, and for good reason, as inflation ticks upwards and global markets ready to fly to safety in an environment of heightened geo-political and trade risks, and tightening monetary conditions led by the US Fed. (May 2018 saw close to USD 5 billion of FII money fly the market, taking the Rupee down to almost Rs 68/USD).

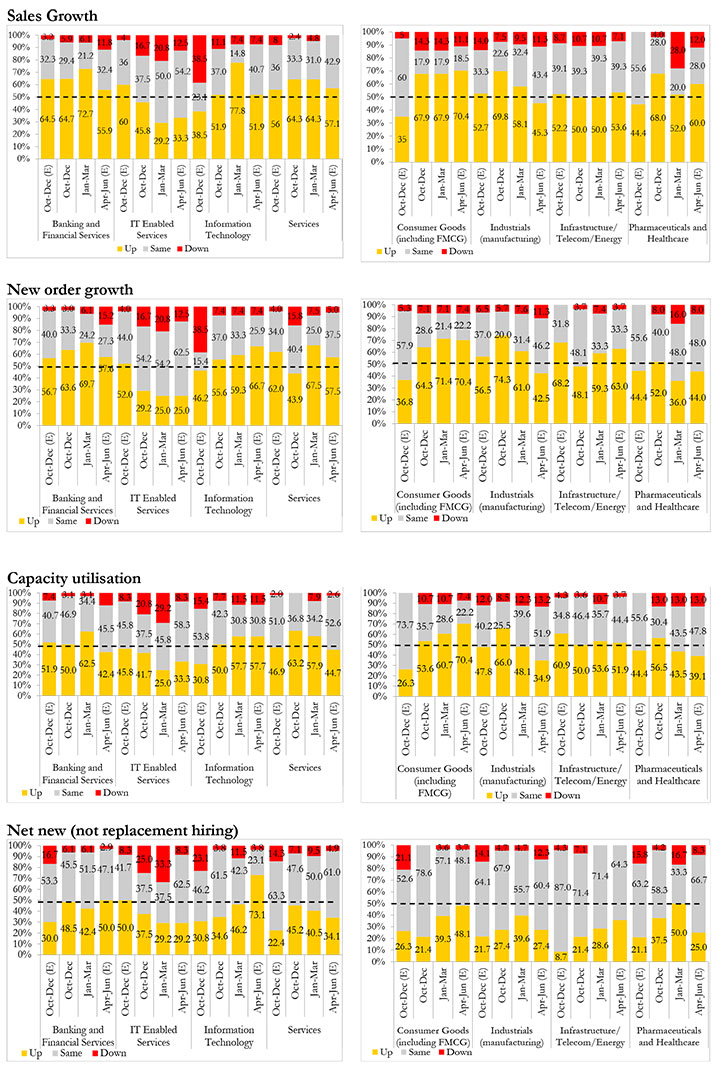

Rising demand then remains an important bulwark, led both by government spend (infrastructure is seeing a clear revival) and consumption (realisation of a normal monsoon will be key here). Signals of higher growth expectations are both anecdotal and statistical. Capacity utilisation is rising across sectors; the overall index, at a pre-demonetisation, pre-GST level of 67.9 is led by consumer goods, IT and infrastructure firms, where more than 50% of respondents in each case see utilisation rising further than in the previous quarter. Discussions with IMA’s members in sectors like commercial vehicles on one hand and back-up power installation providers on the other, all point to a significant increase in demand – order waitlists are becoming once again the order of the day, no pun intended. Both sectors are strong indicators of an expanding economy. Vendors to core sectors like cement and steel also highlight a resurgent order book, led primarily by new work in infrastructure sectors like roads and railways.

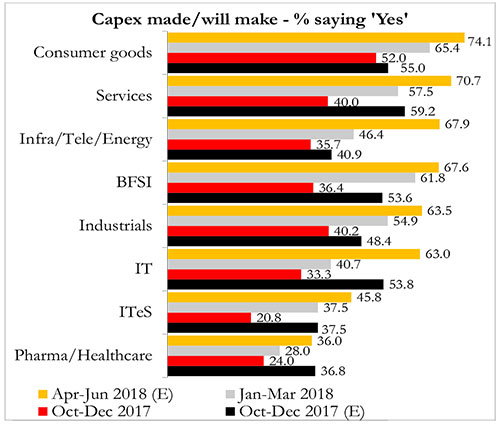

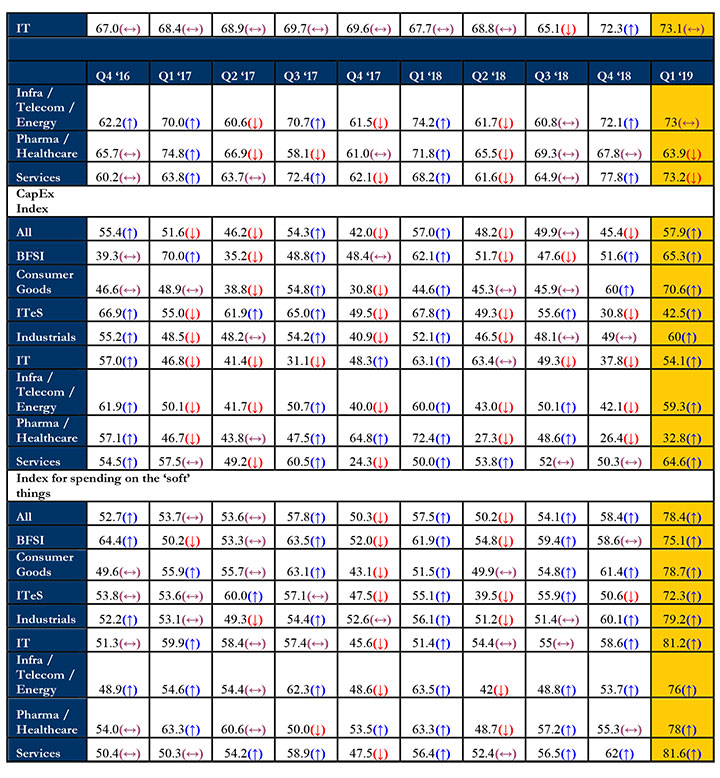

In response, CapEx plans are becoming far more positive, with 75% of consumer goods firms and 68% of infrastructure and energy companies expecting to expend capital in this first quarter of the year. Clearly, some of this is the result of a certain optimism around capital spending at the start of every fiscal, but two factors suggest that ‘this time may be different’: first, the timing of the survey, late in Q1, means that it is likely to more closely track actual decision-making; and second, the CapEx index number (57.9) stands at a multi-year high, just exceeding the year-ago level (57), but head-and-shoulders above the recessionary figures seen in recent quarters.

This is still some distance below the ~65 levels seen in the early 2010s but what makes this especially credible is that, in 6 of our 8 sectoral grouping, 63-74% of companies expect to sign off on new capital spends this quarter, up strongly from January-March. Growth quite clearly, will drive fresh investments.

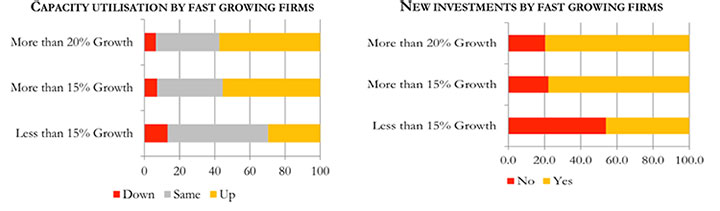

Tellingly, far more (~50%) firms growing more than 15-20% per annum are seeing capacity utilisation rates go up than those at a slower trajectory, and almost 80% of them will make new investments this quarter.

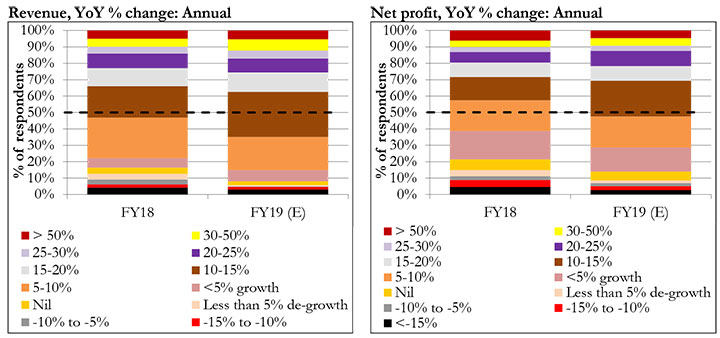

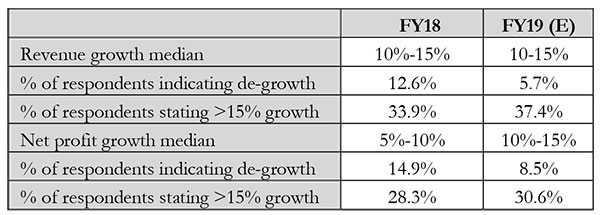

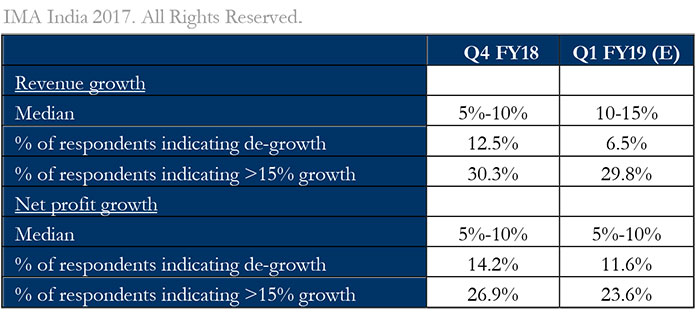

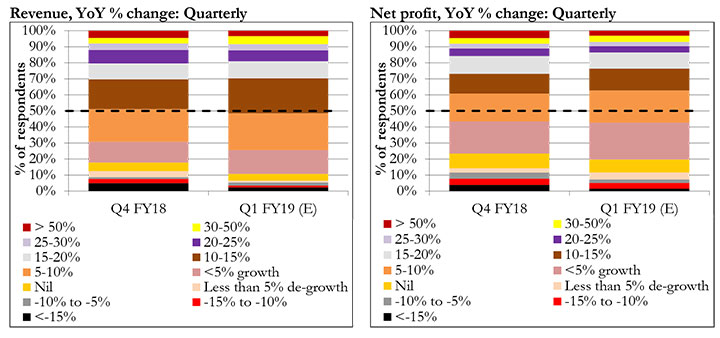

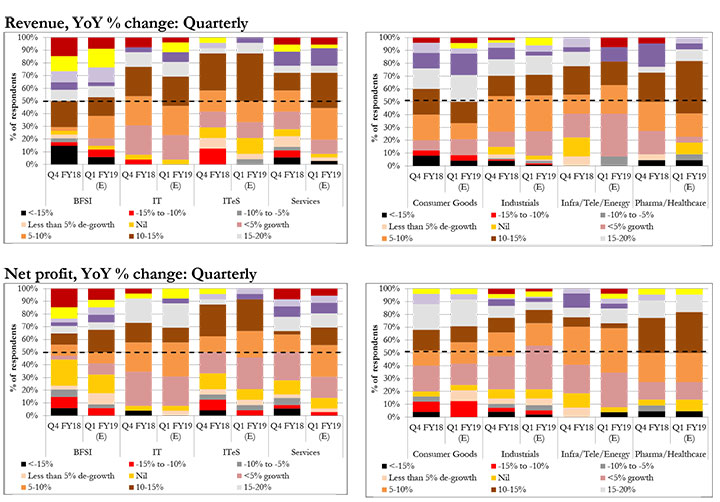

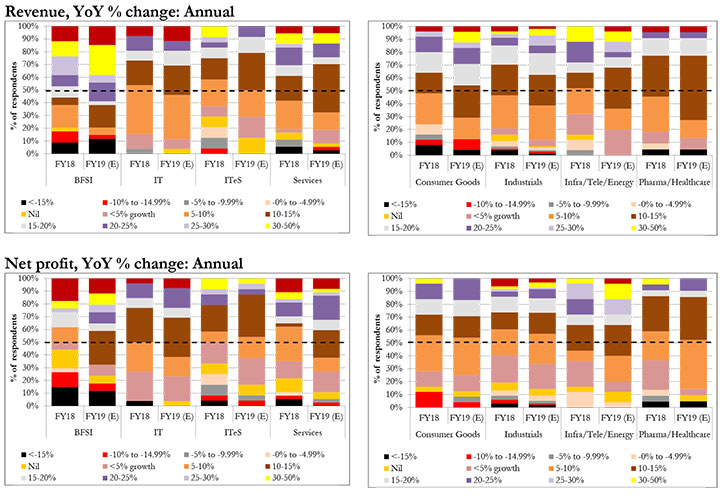

For industry as a whole, and almost uniformly across sectors, top- and bottom-line growth is forecast to edge up this year. At the median, revenue growth is expected to come in at 10-15%, the same as last year. Notably, though, far more firms (65%) expect growth beyond 10%, compared to the 53% who beat that level in FY18. (Barring bullish BFSI, which forecasts 20-25% top-line growth, every sector has either stayed in or moved up to the 10-15% range.)

Reflecting this up-tick, the number of firms expecting de-growth has also dropped dramatically to just about 5% on the count of revenue, and 8.5% on the count of profit, a fall to half the level of FY18. 30%-40% of the respondents expect to grow more than 15%.

The most significant bellwether, particularly for services firms, is the fact that the net hiring index (i.e., excluding any replacement hiring) has jumped to a four-year high of 65.3, gaining 14 points from the middle of last year. The services sector hiring index stands at same level as the overall while IT, consumer and BFSI firms stand in the high 70s. Clearly, put together with the rise in the capacity utilisation index, businesses are starting to run into capacity constraints on both the physical and the human resource front and are gearing up for a new phase of growth.

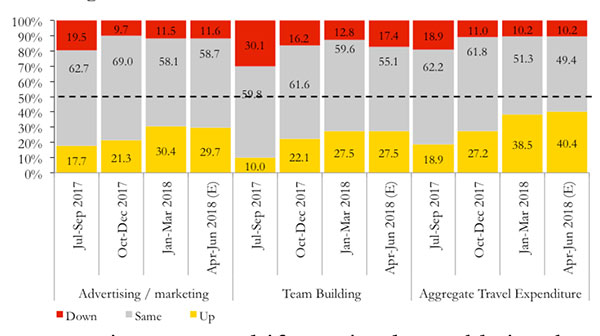

There is also a sharp, step-change in spending on the ‘soft things’ like team/morale-building and especially business travel. From levels consistently below 20% through till mid-2017, anywhere from 28% (team building) to 40% (aggregate travel expenditure) of firms report that they will spend more in Q1 than they did the previous quarter. These are levels unseen in years, and if sustained, would signal, as with hiring, capex, and capacity utilisation, that growth is recovering. Travel spending, plainly, is the strongest indicator of the three, suggesting either that there are new business opportunities to be had, that the competition is becoming more fierce – or both. Advertising and marketing spends are also rising, with 30% of the firms seeking to expand spends in this area this quarter.

That said, the immediate term picture is less uniform, and also somewhat less sanguine. The QoQ outlook for sales in Q1 in the financial services, IT, ITeS and industrial sectors is markedly worse than for previous quarters, with fewer companies seeing accelerating growth, and more expecting a weaker April-June. There is also a difference intra-sectorally, with growth led within sectors by firms that can identify opportunities and localise and focus investments and sales efforts on emergent pockets of demand. The tide is not even, and winning firms will be those that have the better capacity to sight demand and the ability to drive sharp shifts in prioritisation.

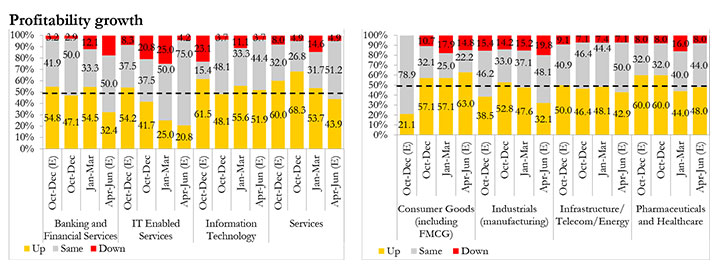

Profitability is also constrained in a number of sectors, with the majority of firms in sectors beyond infrastructure and consumer goods – especially BFSI, ITeS and industrial firms – expecting either lower or unchanged QoQ profitability this quarter – the result of rising input costs in both the manufacturing and the services sector. These firms are also seeing a pullback in capacity utilisation, as are pharma and healthcare companies.

Margins will clearly be under pressure in certain sectors in response to still-tepid demand. In many ways then, the India growth story is, for its players in industry, still one of unevenness. CFOs of IMA’s member firms, when surveyed, reflect a clear hardening of pricing power in certain sectors but on the other hand, find either demand dull or rising inflation in input commodities eating into margin. Liquidity pressures in the coming time will add a layer of further concern as the RBI tightens rates (it effected a 25 bps increase in the repo rate for the first time in four years recently due to external market concerns and rising inflation). Care of the wider vendor and dealer eco-system will become the need of the hour in order to ensure that firms are able to take advantage if the risk should finally be on the upside in a pre-election year.

--------------------

IMA Research for CFO Connect

AFTER HOURS

Most European vacations are a blur of city-hopping and ‘must-do’ sightseeing. Not for us, at least not this time, when we returned to Barcelona after a two-and-a-half-year gap.

Our monthly roundup of new gadgetsGADGETS

Apeman

D.A.D. 2

THINK TANK

PEOPLE

INSIGHT