COVER STORY

The Turnaround Specialist

Broadly, there are four types of CFOs. The ‘deal maker’ is good at restructuring balance sheets and executing M&A transactions. The ‘accounting expert’ is good at reporting and closing books. The ‘operational steward’ understands the drivers of the business, while the ‘strategist’ uses his financial perch to help the management team drive strategy and outcomes. A successful turnaround CFO, however, is one who possesses all four competencies. Gopal Mahadevan, Chief Financial Officer of Ashok Leyland (AL), and this year’s ‘CFO of the Year’ at IMA’s 2018-19 India CFO Awards, is exactly that sort of turnaround specialist.

When Mr Mahadevan took over as CFO of AL in July 2013, the company faced an existential challenge. Its debt-equity ratio stood at 2.4, its EBITDA was turning negative, its working capital stood at 47 days, and the stock price had fallen to Rs 12. AL was completely cash-strapped, with no means of sourcing debt or equity. Under Mr Mahadevan’s watch, the bulk of the turnaround was achieved in three quarters by optimising costs and overheads, disruptively reducing working capital from 47 to 14 days, releasing nearly Rs 1,000 crores of cash; and raising USD 110 million of fresh capital through a QIP at Rs 36 per share. Critically, as well, AL’s MIS was restructured completely, giving quality of insight to operating businesses that, as this story will illustrate, enabled fundamental decisions in favour of sustainable growth.

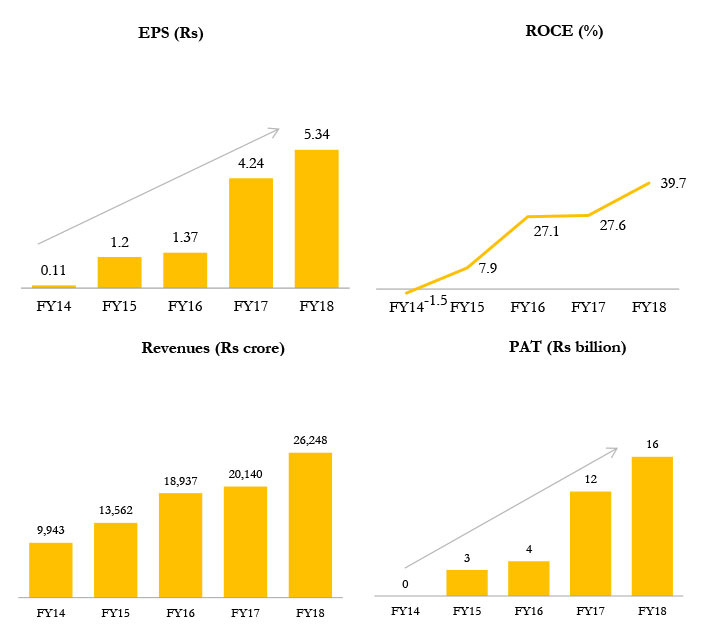

AL’s turnaround was possibly one of the fastest in Indian corporate history. It required re-engineering, re-thinking and re-imagining almost every aspect of the company’s operations. The Finance team played a critical role in the transformation –questioning the status quo, showing the mirror to business, and pursuing outcomes incessantly. The numbers tell the story: net cash reserves swelled to nearly Rs 3,000 crores by end-March 2018; EBITDA has been in the double digits in 12 of the last 14 quarters; revenue went up 2.5x, from Rs 9,943 crores in FY 14 to Rs 26,248 crores last fiscal; and the stock price touched a new high of Rs 167 in May 2018, making it one of the best-performing auto stock in India over the last four years. To achieve all of this, AL adopted best-in-class practices on MIS, working capital management, M&A and investor relations. Despite a linear increase in revenues, the Finance team size came down from 285 to 232. In Mr Mahadevan’s words, Finance provided the ‘binoculars’ of opportunity and efficiency.

Seeking to revive growth, Mr Mahadevan framed a multi-pronged restructuring plan. The focus was on reducing cash leaks and deleveraging the balance sheet, all while growing market share. This meant revising the portfolio mix, selling non-core assets, and reducing manpower costs and operating working capital – all of which required working closely with the business. Finance worked on cost reduction initiatives at three levels: operating, material and design. A systematic plan was put in place to regularly review finely segregated costs against budget. These initiatives saved incremental costs of Rs 500-600 crores, which could be channelled into new businesses initiatives, new markets, quality-enhancement efforts, and also, critically, remuneration, allowing AL to become a top-quartile paymaster.

To gain granular visibility into the drivers of performance, Finance moved from a consolidated P&L to publishing 450 P&L accounts every month that covered every aspect of operations. This has helped drive market share, profitability, costs and cash flows. To ramp up efficiency and strengthen the customer focus, Finance spearheaded a process-improvement drive – ‘Aspire’ – that allowed a 20 per cent increase in productivity across four functions – HR, Finance, Quality and Indirect Purchases.

In parallel, AL focused on optimising its working capital management, automating processes to identify any inefficiencies in this area. Three years ago, Mr Mahadevan split working capital into 14 separate ‘boxes’, all of which were – and continue to be – managed separately. Today, AL even has a dedicated team to track and manage its ‘concern’ (i.e., aged) working capital. These efforts have started to yield results: in March 2018, AL achieved negative (-18 days) working capital.

Aside from driving the reduction of operating capital, Mr Mahadevan proposed scaling-down the value of investments, and selling non-core assets. In the last four years, AL has sold assets worth Rs 1,600 crores and impaired investments to the extent of Rs 1,400 crores. This has helped drive the ROCE to a record high (39 per cent in FY18), prompting a rating upgrade to AA+.

Throughout its turnaround, AL never lost sight of new growth opportunities. Mr Mahadevan himself led the acquisition of a light commercial vehicle (LCV) business from Nissan, structuring a deal that was a win-win for everyone. (Within 12 months of acquisition, a loss-making business turned PAT positive, and the LCV business has become crucial to AL’s growth in both the domestic and the international market.) The negotiations were long-drawn, but finally closed in an amicable manner. More generally, to balance the twin aims of strong business and ROCE growth, the capex process was strengthened, and capital allocation is now reviewed periodically. Ashok Leyland’s medium-to-long-term metric is to have a 1:1 debt:EBIDTA – as opposed to debt:equity – ratio. The logic behind this is that a year’s worth of EBIDTA should be sufficient to pay back the company’s debt at any point.

Mr Mahadevan has also, by means of consistent and transparent communication brought greater traction to investor relations. Instead of merely conveying the ‘good news’, he regularly talks to investors about the challenges AL faces. During the HFL merger, he had to personally allay the fears and concerns of more than 100 investors.

This cover story of CFO Connect builds on an earlier (March 2018 issue) conversation with Mr Mahadevan, lending deeper insight into his own role in bringing a fabled company back from the brink.

Optimising Costs

What initiatives were taken to reduce costs? What was the role of Finance in this?

It was not merely cost-cutting but methodical cost optimisation, involving all aspects of the organisation – material, engineering, design, overheads – and more importantly, productivity. There were specific programmes for each segment, and a high degree of measurability of outcomes. However, above all, collaboration was crucial. As a first step, we put together a dedicated team of 25-30 employees by handpicking the best people from various departments. The Project – codenamed ‘K-54’ – was given the mandate of reducing the break-even and cutting all costs, including interest, depreciation, and non-cash charges to improve PBT.

AL’s turnaround was possibly one of the fastest in India’s corporate history. The Finance team played a critical role in transformation by questioning the status quo, showing the mirror to business, and pursuing outcomes incessantly

Cross-functional teams worked on multiple projects in the areas of material, manpower, overheads and operating leverage. Operating costs (both manufacturing and SG&A) are reviewed annually on a zero-base budget and classified into ‘vital’, ‘essential’ and ‘desirable’. Through this exercise, we have been able to pour limited resources into areas where money was required – new businesses such as electric vehicles, new markets and quality enhancing initiatives such as Deming. Ashok Leyland is the only commercial vehicle manufacturer in the world to have won two Deming awards.

Material cost reduction was done through a separate programme, which involved alternative design, alternative procurement, consolidated buying and zero-based costing of critical components. A team of engineers and cost accountants was created to review and measure cost and classify target costs into different heads (alternative design, new materials, bulk negotiations etc).

The Finance function led a systematic cost optimisation programme to focus all on aspects of the organisation – material, engineering, design, overheads – and more importantly, productivity

Employee costs were also trimmed: low performing employees constituting 10 per cent of the total employees were offered voluntary retirement. At the same time over the years, manpower costs and productivity were more closely linked more. Today, Ashok Leyland stands in the top quartile in the industry in terms of compensation.

Finance as a function played a critical role of not only showing the mirror, but also providing the ‘binoculars’ of opportunity and efficiency. A systematic knowledge-management structure was set up to invite cost-cutting ideas from across the organisation, and to track implementation. Every idea at AL now goes through three stages and is then validated by the Finance team. To enable greater efficiency as well as a strong focus on customers, Finance spearheaded a process improvement initiative – Aspire (Ashok Leyland Programme for Productivity Improvement and Re-engineering) – that brought productivity improvement to the tune of 20 per cent across four functions (HR, Finance, Quality and Purchases).

The result of AL’s efforts is improved efficiency and a stronger focus on customers across the HR, Quality and Purchase functions

Finance also rolled out 450 P&L accounts across the company so that each business, SBU, zone, region and area can review the performance against plan on three critical parameters – EBIDTA margin, operating working capital (interest) and market share. This helped the business to continuously course correct on profitability.

What were the tangible outcomes of these initiatives?

The results have been pretty explicit; the team managed to remove Rs 500-600 crores of operating and material cost incrementally. From a company that posted a negative EBIDTA in Q3 FY14, Ashok Leyland is now the most profitable CV company in India, with double-digit EBIDTA margins in 12 out of 14 quarters. Despite exceptional charges and also high raw material prices, the EBIDTA margins have been consistent. In terms of tangible outcomes, revenue increased to Rs 26,248 crores (FY18) from Rs 18,937 crores (FY16); EBITDA jumped to Rs 2,739 crores (FY18) from Rs 2,255 crores (FY16); net income saw a four-fold increase from Rs 390 crores to Rs 1,563 crores between FY16 and FY18 while ROE increased threefold from 7.2 per cent to 21.8 per cent. This was achieved despite a significant rise in material cost and heavy discounting in the market.

AL’s medium term metric is to have a debt:EBIDTA ratio of 1:1 to ensure that one-year EBITDA is sufficient to pay back the company’s debt

How do you expect to sustain the benefits over the long term?

The best part of these programmes is that they are self-sustaining, evergreen processes involving idea generation and knowledge management processes led by Finance. Each of these programmes is run by the best middle-level managers (emerging leaders) who are continuously mentored by the leadership. We expect margin improvements from these initiatives to sustain our competitiveness even in difficult market conditions.

Tracking Performance

How do you ensure strong alignment between effort and outcome?

For people to turn around a company, they should first know what to manage. We earlier had one consolidated P&L. MIS systems have been completely revamped over the last two years. Today, AL is possibly the only company of its size that publishes 450 P&Ls every month covering every minute operation. This has been critical in turning the company into a high-performance organisation. Further, our analysis of sales and costs provide dashboards, which are extremely incisive and pertinent. A ‘Stars & Tails’ report provides an analysis of the portfolio, margins and volumes. Our accounts are finalised at the end of the first working day each month and MIS is ready by the third working day, along with a full analysis of the performance. Our quarterly forecasting and Annual Business Planning exercises are very robust which helps us steer the ship consistently. This is crucial as the environment is changing continuously.

Moving from a consolidated P&L to publishing 450 P&L accounts every month helped drive market share, profitability, costs and cash flows

Restructuring The Balance Sheet

What steps did Finance take to improve the firm’s capital efficiency and cash generation capability?

To improve capital efficiency, we brought in a very robust capital budgeting process. More importantly, the outcomes of capex decisions and vehicle programmes were measured post launch, and to help make course corrections where necessary. Crucially, the organisation was sensitised to the concepts of capital allocation and cost of capital.

We not only reduced the working capital, but also evolved a process for it. Three years ago, we devised a 14-box break up of operating working capital where each box is managed by a leader in the organisation. We have now gone to the next level – managing what we call ‘Concern Working Capital’ (CWC) – where the aged working capital is reported separately and managed by separate teams. Importantly, all of this is automated. This system is unique and has yielded exceptional results. In March 2018, we had negative working capital of 18 days.

How has AL’s investment policy changed over the years? What has been the outcome?

Over the past few years, the company has methodically stepped down the carrying value of certain investments, and also has sold non-core assets. This helped to bring down the size of the balance sheet and also to have realistic carrying values. In the last four years, we have sold non-core assets worth Rs 1,600 crores and impaired investments to reduce their carrying value. Impairments have been to the tune of Rs 1,400 crores, and for the last two years, the numbers add up to Rs 400 crores. The effect of this has been increased ROCE which has resulted in value creation – FY 2017-18 had a record ROCE of nearly 39 per cent. Consequently, after 20 years, AL’s ratings got upgraded to AA+ (by Care), a step away from AAA.

In the last four years, AL has sold non-core assets worth Rs 1,600 crores and impaired investments to the extent of Rs 1,400 crores

Unlocking Value through Deals

What deals have you executed recently? How did they benefit AL?

There were three deals that were executed in the past 18 months. The first was the acquisition of the Light Commercial Vehicle (LCV) business of Japan’s Nissan Corporation. The LCV business – core to AL’s commercial vehicle business – was split across three joint ventures between AL and Nissan. This was completed in December 2016, with the buyer paying no consideration for the business.

An automated process to review inefficiencies in working capital management helped achieve a negative working capital of 18 days

The second was a merger of Hinduja Foundries (HFL) in which AL had a 2.2 per cent stake, but HFL was a critical supplier of almost 100 per cent of our engine blocks and heads. The merger was completed in March 2017 and resulted in tax benefits of Rs 348 crores for the company. The LCV and Foundries businesses are very critical to AL and more importantly, both have been turned around in a short span of 12 months post-acquisition.

The third was an acquisition of shares of Hinduja Leyland Finance Ltd (HLFL), a subsidiary of AL from Everstone, which has been accretive to Ashok Leyland.

What integration-related challenges came up after these mergers/acquisition? How were they overcome?

Both the merger deals had their challenges. The acquisition of the LCV business involved extensive negotiations with Nissan spanning over a year, and there were important issues to be resolved even as the negotiations were on. The deal structure was also unique. Today, the LCV business is profit making in just a span of 12 months from the time of the takeover.

The HFL merger was complex given that both AL and HFL were listed and the perception of the merger was negative. This involved a lot of communication with investors to ensure that there was no value erosion in the sum-of-parts. The deal also involved minority shareholders assent and constant communication and astute tax planning. Today, HFL has been turned around and has posted an EBIDTA of 5 per cent for FY18. The deal has resulted in tax benefits post-merger.

What exactly was the role of Finance and specifically, your own role, in these deals?

I predominantly lead the negotiations for the acquisition of the LCV business from Nissan. Successful execution demanded a deep understanding of the technical aspects of the LCV business, technology transfer, taxation and of course, hard negotiation skills. While the negotiations were quite extended, the relations remained cordial. It was critical that the morale of dealers, customers and the business teams was not impacted.

The HFL Merger with AL was conceptualised and executed by the members of the Finance team, who did an exemplary job. This involved intense communication with the external world as the merger had to be approved by minority shareholders separately and most investors saw the deal as value depleting. The post-merger integration was completed seamlessly including the mechanics and structuring of the swap ratio. This deal helped to streamline and turn around the ailing company into a robust division of Ashok Leyland in just twelve months, and additionally resulted in tax benefits.

I personally was involved in the negotiation of the part stake sale of HLFL from Everstone. As with any successful M&A, it was a win-win for all stakeholders.

What benefits of the specific deals will accrue in the future? In what time-frame?

The LCV business will lead the foray of AL into new markets outside of India. The company is planning a slew of product launches as the business is being managed independently by AL. The merger of the LCV subsidiaries is expected to be completed in the next nine months subject to statutory approvals.

The foundries business is very critical to AL as this provides the critical castings – cylinder blocks and heads – for the engines of the commercial vehicles manufactured by AL. That aside, the management is focused to drive up operational performance of the now-merged Foundries Division so that its EBIDTA margins become accretive to AL in the medium term. Revenue growth is also expected, but very clearly, the strategy is to improve productivity and profitability even as the division adds some key accounts.

The acquisition of shares in HLFL from Everstone has helped Ashok Leyland to increase its stake in the subsidiary. This will help Ashok Leyland in still holding a majority stake after factoring in dilution that may happen in the future.

Ashok Leyland never lost sight of new growth opportunities. The acquisition of LCV business from Nissan was extremely accretive to the company, while the merger with HFL led to tax savings

Keeping Shareholders Informed

What steps were taken to keep the shareholders informed and crucially, to gain their confidence?

Investors, bankers and internal management were provided detailed assessments of decisions taken and progress made, including, crucially, errors or disappointments. In the case of internal stakeholders, it was essential to involve them early on to avoid any possible resistance. The strategy has been to communicate with investors both the good and the bad, especially more so when there are concerning developments. Case in point, when the HFL merger was announced, I personally spoke to more than 100 investors to address their concerns, as they were concerned about the announcement. In another instance, when the move from BS-III to BS-IV was announced almost overnight on 28th March 2017, AL was one of very few corporates to schedule a call with investors to help them understand the implications of such a transition.

Finance’s role in ensuring M&A success involves a deep understanding of the technical aspects of the business, technology transfer, taxation and hard negotiation skills

Staying Relevant

As AL looks ahead, what are the strategies to push the company from good to great?

Going forward, Ashok Leyland has three broad goals on revenue: pursue domestic growth; grow acyclical businesses; and drive-up the share of international revenue. While the domestic truck business remains its bread-and-butter, it is important to de-risk the organisation by growing other businesses in parallel, and there are programmes in place to methodically achieve this. At the same time, AL is moving from being a pure products business to becoming a ‘solutions’ provider. From building innovative trucks, it is now making them digitally-enabled and intelligent. Further, the company is now looking to capture more of the entire lifecycle revenue of a vehicle and not merely its sale value, which accounts for just 10 per cent of the total opportunity.

What role will Finance play in executing these strategies? How has your role evolved over time?

Finance is integral to this Blue-Ocean strategy. It will need to partner business in driving this as decisions on capital allocation, revenue streams, investment structure and funding will need to be the backbone for these initiatives.

My impact on the firm is not just on elements core to the CFO’s role – cost, risk liquidity/funding management and margin maximisation – but on identifying opportunities within the business. Today, I am additionally responsible for the Customer Solutions business of Ashok Leyland.

Over the next decade, technology will cause disruption on account of AI and automation. What are the disruptive trends you foresee? How prepared is AL in terms of embracing change? Specifically, what challenges do you think it will pose for Finance?

Historically, the first value creators were manufacturing behemoths, followed by the ones with marketing capabilities, and then by technology leaders. The next phase of value creation will be led by companies that innovate in connecting and retaining customers, and creating needs that did not previously exist. You need to be prepared not only for disruption but also for the unbelievable velocity of disruption.

AL is moving from a pure products business to a solutions provider with an aim to capture more of the entire lifecycle revenue of a vehicle

We are very clear that we need to move from products to solutions, and from hardware to digital.

For CFOs, all of this will pose critical challenges in terms of decision-making. They will need to move their mindset from managing risks to riding them. Innovation will be key to staying relevant, and also to staying ahead.

CFOs are required to move their mindset from managing risks to riding them. Innovation will be key to staying relevant and also to staying ahead.

How do you expect to sustain these results in the future?

The current cost base and its optimisation helped the company sustain good profitability despite a steep rise in raw material prices as well as heavy discounting of its commercial vehicles. We expect that this optimised cost base will help the company post stable and growing margins in the medium term, and to stabilise ROCE between 20-25 per cent on a steady state, which is excellent for a business that is very capex heavy. Operating working capital is now at very low levels – negative currently – but will not be higher than 14 days sale, which is best-in-class. The turnaround has also helped in improving productivity across functions. The best part of the turnaround is that we invested in doing it through structural shifts and continuous improvement programmes instead of just a one-time effort.

INSIGHT

VIEWPOINT

Over the last two decades the CFO’s role has evolved from crunching data, into providing strategic insights and really a more wholesome partnership with various aspects of the organisation...

Over the last two decades the CFO’s role has evolved from crunching data, into providing strategic insights and really a more wholesome partnership with various aspects of the organisation... The most effective CFOs today are those who add value beyond the traditional Finance activities of accounting and control, and deliver on strategic outcomes...

The most effective CFOs today are those who add value beyond the traditional Finance activities of accounting and control, and deliver on strategic outcomes... Despite its reasonably good macroeconomic fundamentals, the Indian currency has declined by over 15% since the start of 2018...

Despite its reasonably good macroeconomic fundamentals, the Indian currency has declined by over 15% since the start of 2018...  CFOs are uniquely positioned to add huge value during an M&A transaction. Everything from target identification to due diligence...

CFOs are uniquely positioned to add huge value during an M&A transaction. Everything from target identification to due diligence...  Here is what Jack Ma had to say of Daniel Zhang as he passed on to him the torch of chairmanship of Alibaba, “His analytical mind is unparalleled....

Here is what Jack Ma had to say of Daniel Zhang as he passed on to him the torch of chairmanship of Alibaba, “His analytical mind is unparalleled.... A while ago, I had the opportunity to meet with a senior executive at my company. Over dinner, I posed to him a question on something that has become...

A while ago, I had the opportunity to meet with a senior executive at my company. Over dinner, I posed to him a question on something that has become...