BIG PICTURE

GLOBAL OUTLOOK | REGIONAL OUTLOOK | INDIA OUTLOOK

Global Outlook

Prepare for upside surprises in demand, for shortages in supply, rising inflation and interest rates, and for a strong dollar

The Global and Regional Outlook is extracted from the Asia Pacific Executive Brief, a service of IMA ASIA.

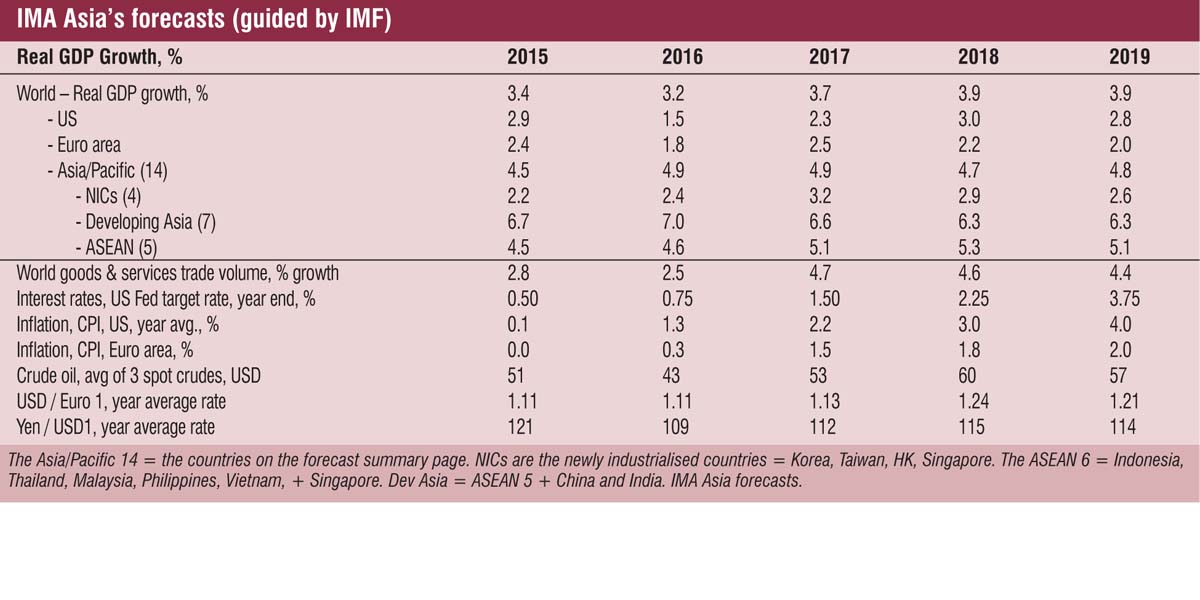

Three days before the US stock market correction in February, we headlined the Asia Brief with “The key messages in this month’s Asia Brief are to prepare for upside surprises in demand, for shortages in supply (of goods, services, and people), for more inflation and rising interest rates, and for a return to a strong US$ by mid-2018”. We wrapped up the global outlook by suggesting that this should have little impact on stock markets, although they were clearly ready for a correction. Oh, if we could just go back and rewrite that last bit given the 10% fall for the S&P500 a few days later. However, we are happy to stick with the headline sentence. This month’s review of markets finds most indicators pointing to sustained global demand growth. The main takeaway is that volatility has returned to global capital markets and that major currencies (US$, Euro, and Yen) are moving, and companies operating in Asia need to take both into account.

There is today a globally synchronised recovery underway across the 40 largest advanced and EM markets, built on better balance sheets and a better demand/ supply balance

With interest rates rising after a prolonged period of ultra-cheap money, a key issue is who gets hurt. It’s not so much the higher rates, which will be low by historical standards, as an end for strategies built on ultra-cheap money. Two groups stand out. First, the OECD has warned that public debt for the world’s main developed economies has more than doubled from US$25tr in 2008. Some 40% will be refinanced in the next three years with a significant increase in cost (as opposed to the small increases of the past decade). Apart from a current push into longer dated bonds, that likely means more taxes and less spending ahead for some advanced economies, which will slow growth. A second group to watch according to the Bank of International Settlements (BIS, the central bank for central banks) are zombie firms kept afloat over the last decade by ultra-cheap money. They are estimated at 10% of all companies in Europe (a similar percentage is likely in the US). Frankly, better run firms will be happy to see them go, as they misuse capital and labour, and hurt pricing power.

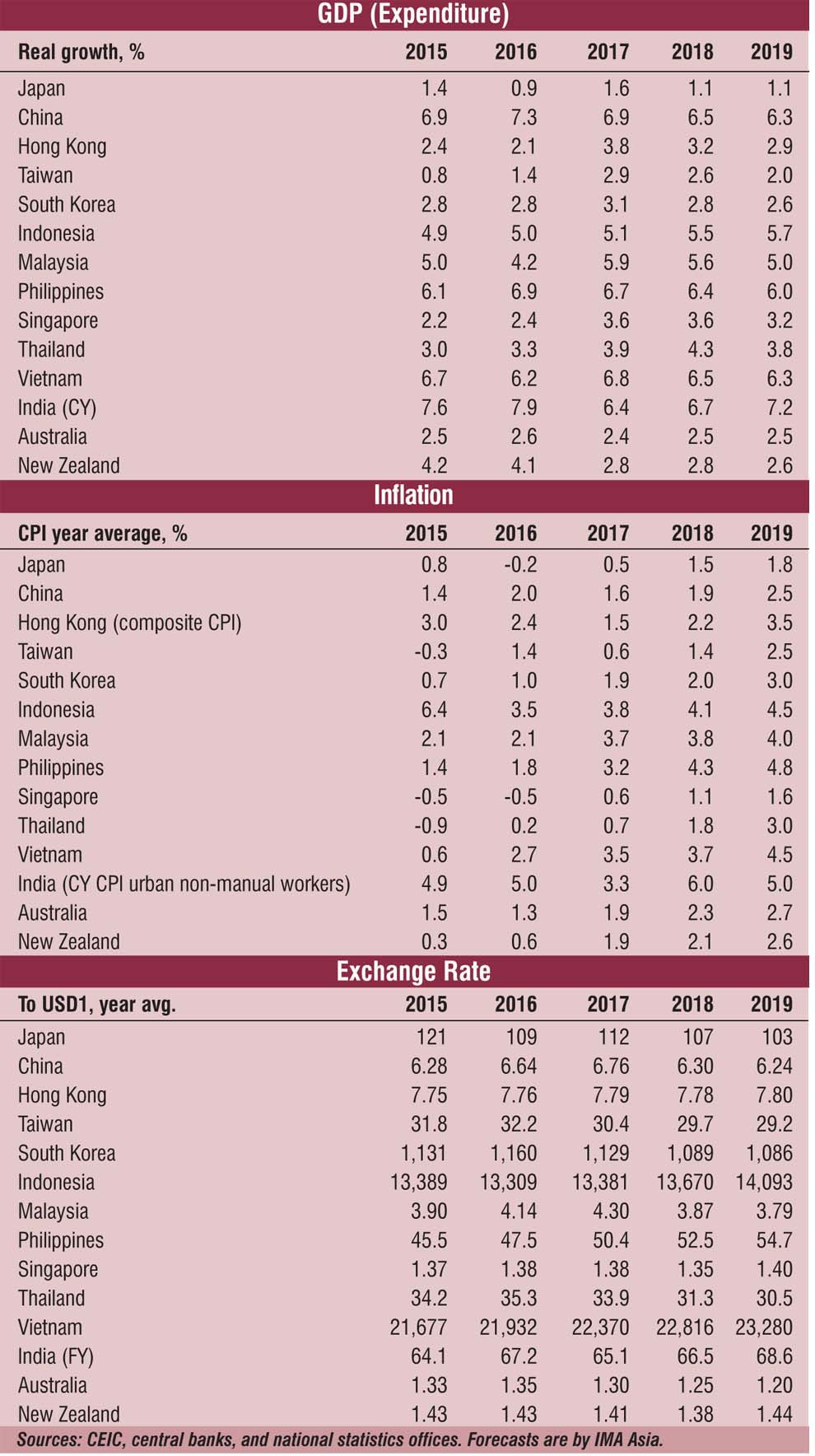

The demand story for the last year has been a globally synchronised recovery across the 40 largest advanced and emerging markets built on better balance sheets and a better demand/ supply balance. Both improvements typically take 7-10 years to emerge after a big asset price bust. Looking forward, the story is crystallising into a stronger than expected Euro zone recovery and a potentially surging US economy, as the Trump tax cuts kick in for an economy already running at close to capacity (based on low unemployment and full industry order books). We see the 100% immediate depreciation for capex on plant and equipment as having as big an impact on growth, as does the cut in income taxes. That is likely to push inflation and interest rates up faster than markets expect. These two developments will have a broad spill over for the global economy, which is apparent in the unexpected and rapid rise for the Euro on the US$ over the last six months. Generally, a strong Euro zone and a surging US are very positive for Asia, as they should bring a second straight year of stronger than expected exports. Moreover, most of Asia is well positioned to handle a lift in interest rates, as all but Vietnam of the 14 economies we cover have investment grade ratings. Despite that, the ones to watch are India, the Philippines, and Indonesia.

Unlike 2013, when hints of a lift in US interest rates led to a “taper tantrum” with many emerging market currencies falling, the last six months has been characterised by a major realignment of the big currencies – US$, Euro, and Yen. We see this mostly as global capital repositioning for unexpectedly strong growth in the Euro zone and Japan. We also expect the US$ to regain ground later in 2018, as the US Fed lifts rates. Such big rises on the US$ for the Euro and Yen will affect competitive positions for MNCs across Asia.

Regional Outlook

2018 will be a strong year for Asia, but one also marked by a dominant Xi Jinping, and the possibility of a US-China trade war

President Xi Jinping’s removal of a term limit for the presidency of China leaves China with a uniquely powerful leader, who has the ambition and authority to reshape both China and China’s position in the world. Mao may have paid lip service to the occasional global idea, but never had the capacity to do much beyond China’s border (the Korean and Vietnam wars being two exceptions). Xi is keen to realign geopolitics across Asia, and now that it’s clear he could lead China for a decade or more – out-distancing every other regional leader and several US presidents – the realignment should be expected. That this comes at a time when US foreign policy has collapsed under a populist president simply accelerates the shift. Countries like Malaysia and the Philippines have swung to China already. Vietnam and North Asia (Japan, Taiwan, and Korea), as close neighbours, will find the transition difficult. How it plays out in countries like Thailand and Indonesia will be interesting. It will change the playing field for Western MNCs operating across Asia, putting China alignment on the agenda even for firms not operating in China. That already applies to major projects (driven by One Belt, One Road) and will increasingly play a role in government procurement, trade policy, and the position of PRC firms in a wide range of industries as they develop their international operations.

Mr Xi is keen to realign geopolitics across Asia – a shift that is being accelerated by a US foreign policy under a populist president, and one that will change the playing field for MNCs operating across Asia

Against this transition, the looming China-US trade spat is, for China, just one step on a long path to establishing a China-led global structure. In March, the Trump administration imposed duties on the import of Chinese steel (25%) and aluminium (10%). While that will hurt many more US firms and workers than it helps, it also comes at a time when shortages and price hikes emerge across the US capital goods sector. China has sent some of its top people to the US to negotiate a compromise, but once pushed to act it will place long-term goals well ahead of short-term gains (an exact opposite of the US administration). Moreover, for the Trump administration the spat is all about a domestic political agenda; for China its all about a global agenda.

Given our global outlook, it is likely that we have under-estimated Asia’s growth this year, as a strong Euro zone (with a strong Euro) and a surging US economy will trigger stronger exports from Asia than expected in our current forecasts. The main beneficiaries will be countries such as China, Korea, Taiwan, and Vietnam. Malaysia, Thailand, and Singapore should also do well. A strong Yen may limit the export boost for Japan, but it already has a surprisingly strong local demand upturn underway. Much the same could be said of the Philippines. For India and Indonesia, domestic issues will play a bigger role in shaping growth (we expect growth to be slightly better in both), while for Australia and NZ, it will be a mix of China demand and local issues that determine growth.

In our end of the month catch-up sessions with Asia CEOs in Singapore and HK a consistent theme for the last few months has been shortages of skilled staff and managers. This perennial problem comes in waves, and in 2018 the wave is peaking. It’s time to focus more energy on the dozen or so standard steps to hiring and retaining good staff, and to look for some new tactics. Being out of staff is as damaging as empty shelves.

After years of low inflation, with bouts of deflation, inflation rates are moving up across Asia. That is mostly due to strong demand and emerging shortages in supply chains. Oil prices have jumped, but rising Asia currencies on the US$ have cushioned that. The growth in labour costs is modest so far, but that could be one of the nasty surprises in 2H’18. All of that creates an environment in which firms will have greater scope to adjust prices, and that will be essential for some if their input costs are rising quickly. It may make it easier for Euro and Yen based firms to adjust prices, as their base currencies are climbing quickly against Asian currencies, while the US$ has fallen.

We’ve long considered Asia’s competent central bank heads as a plus for regional growth and stability. The first half of 2018 will see some of the key players retire. The most important change is the retirement of Zhou Xiaochuan (70), China’s longest-serving central bank head (from 2002). New central bank heads also take office in the Philippines, Indonesia, and Taiwan. The notable exception is Kuroda in Japan, who has just gained an unusual (for Japan) second term. In all cases the new central banks heads look to be competent replacements, and that means they’ll moves policy rates up ahead of inflation.

Richard Martin is Managing Director, IMA Asia. He can be reached at richard.martin@imaasia.com

India Outlook

The BJP continues to expand its political footprint while the economic recovery gathers steam

The BJP achieved more victories in recently concluded assembly elections in 3 north eastern states. In Tripura, it trounced the Congress and the incumbent Left front to win 43 out of 59 seats. In Nagaland, its coalition NDPP won 29 out of 60 seats while in Meghalaya it partnered the winning NPP coalition. Historically, the BJP has been non-existent in the three states and it is Narendra Modi’s mass appeal and Party President Amit Shah’s organisational skills that have brought about the change in fortunes. On another count, the party suffered a blow as one of its partners, the Telugu Desam Party (TDP), exited the National Democratic Alliance (NDA). The dispute stemmed from the TDP’s demand for special treatment for its state of Andhra Pradesh which the BJP maintained would breach constitutional propriety.

Mr Xi is keen to realign geopolitics across Asia – a shift that is being accelerated by a US foreign policy under a populist president, and one that will change the playing field for MNCs operating across Asia

The BJP is in power, individually or in coalition, in over 20 states and its influence in the Rajya Sabha will increase in the coming years. The shift began last week with elections to 58 upper house seats. The BJP raised its tally from 54 to 69 while the Congress’ count dropped from 54 to 50 and other parties witnessed smaller changes. As an alliance, the NDA now has 85 seats, not including the TDP’s 6, while the opposition has just over 100. The rest are shared by other regional parties from whom the BJP would seek issue-based support. However, opposition parties still have enough sway to derail proceedings and are in fact upping the ante. The ongoing Budget session has seen almost every sitting washed out, even in the Lower House.

The Cabinet Committee on Economic Affairs approved what is equivalent to the opening up of India’s coal mining sector to the private sector through its decision to auction coal blocks to the highest bidder without restrictions on end use, quantity or pricing. Any player, private Indian or foreign, can now bid and mine coal on a commercial basis. Coal mining was nationalised in 1973; subsequently, private mining was allowed only for captive consumption by power, steel and cement companies.

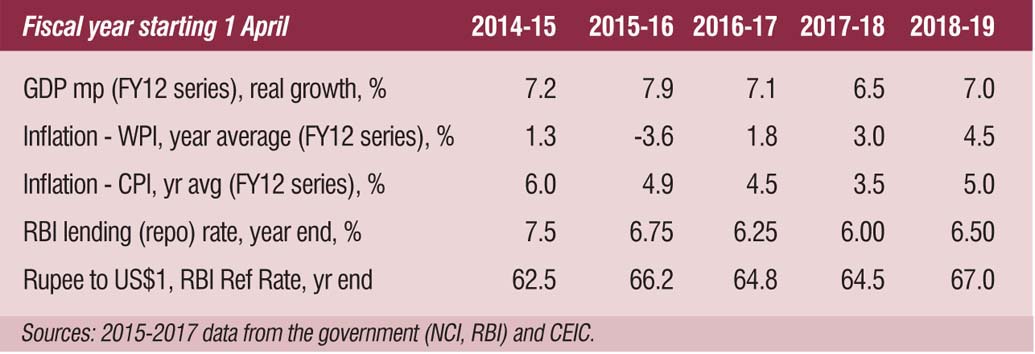

GDP growth for Q3 (October-December) 2017 came in at 7.2 per cent yoy against 6.8 per cent yoy last year and 6.5 per cent yoy in Q2, confirming the ongoing recovery in the economy. Encouragingly, investment provided the main impetus to growth with capital formation rising 12 per cent yoy against 8.7 per cent yoy last year. This is corroborated by IIP growth which increased to 6 per cent yoy in Q3 from 3.9 per cent yoy last year, led by an 11 per cent increase in capital goods production (-1.8 per cent last year). From a sector point of view, GVA growth at 6.7 per cent yoy in Q3 was driven by 8.1 per cent growth in manufacturing, 6.8 per cent in construction and 7.7 per cent in services. Nevertheless, there are reasons for markets to worry. In January, the fiscal deficit for FY18 stood at 114 per cent of the revised target of 3.5 per cent of GDP and even if budget cuts are made, a further slippage is possible. Further, with inflation sticky at over 5 per cent, markets are anticipating a rate hike with 10-year treasury yields moving up from 7.3 per cent to 7.7 per cent through February.