Think Tank

Tourism in India: Significant Growth Potential

The Indian tourism industry has been growing steadily in recent times. Regarded as one of the crucial pillars of the economy, the sector enjoys significant importance. At its current pace of growth, it could emerge as a dominant growth propeller for the economy. However, sustaining the momentum is pivotal and infrastructural gaps could emerge as potential obstacles.

Indian tourism: On the brink of a breakthrough |

|

Growing at a steady pace… |

A melting pot of cultures, religions and languages, India symbolises unity in diversity and its tourism industry is in many ways a reflection of this fascinating miscellany. In the last 5 years, the sector has grown by a steady 9.6% per annum, significantly higher than the global average of 4.6% (2017)1. Its position in the World Economic Forum’s biennial Tourism and Travel Competitiveness Index has improved from 65 in 2013 to 40 in 2017 and India ranked 7th among 184 countries in terms of tourism sector’s contribution (9.6%) to GDP in 2017. Clearly, tourism is a substantive component of the economy. |

Tourist traffic: Regional concentration |

|

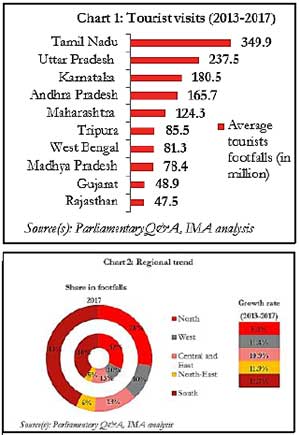

Southern states lead the pack… |

When it comes to sheer footfalls, the Southern states have traditionally dominated. In 2017, for instance, 3 out of the top 5 states with regard to tourist visits (both domestic and foreign) were states from the South (see chart 1). This owes primarily to the region’s rich cultural heritage and scenic beauty. On the other hand, the North-Eastern states have remained relatively unexplored. This is due to a variety of reasons such as abysmal hotel infrastructure, safety issues and poor connectivity. Encouragingly, however, these states, particularly Arunachal Pradesh and Sikkim, have been taking strides in recent years (see chart 2). This is partly a result of a low base but also a consequence of improved infrastructure and better air connectivity. North India which has traditionally been a tourist hotspot, particularly the “Golden Triangle1”, has been losing its sheen. The region’s share in footfalls has dwindled in recent times and its growth rate has slowed down largely due to safety concerns. It may be noted that while footfalls in South India have been growing at a healthy pace, the region has off-late been steadily losing ground to Sri Lanka due to prohibitive policies on alcohol in states like Kerala and Andhra Pradesh and (artificially) expensive hotels. |

Foreign tourist arrivals: Gradual pick up |

|

Foreign tourist arrivals historically low… |

A major lacuna plaguing the Indian tourism industry is its performance with regard to foreign tourist arrivals (FTAs). Although FTAs have doubled from 5.1 million in 2007 to 10.2 million in 20171 (see chart 3), it is still well below international standards. Smaller countries like Malaysia and Thailand attract higher tourist footfalls than India. As such, India accounts for a mere 0.7% of global FTAs. Further, foreign tourist visits (intra-country travel of foreign tourists), which have grown at 8% per annum in the last 5 years, constitute a paltry 1.6% of the overall tourist footfalls in the country. This is due to strict entry norms and cumbersome visa procedures. Perceived concerns over safety and infrastructural bottlenecks have also acted as impediments. The government seeks to raise the country’s global share of FTAs to 1% by 2020 and to 2% by 2025. In an attempt to achieve this, it launched the e-visa scheme in November 2014 which currently extends to 166 countries. The number of e-visas issued has risen sharply from 0.5 million in 2015 to 1.9 in 20171. Tourist Police Units have been launched in several states to address the issue of safety. The UDAN scheme, which has taken off with encouraging results, is helping to enhance connectivity. Consequently, the growth of inbound tourism has increased – in 2017, FTAs in India grew by a solid 16% as opposed to 7% per annum between 2006 and 2016. This is impressive particularly in light of Rupee’s appreciation (making it costlier for foreign tourists) last year. |

Outbound tourism: Steady growth |

|

Huge potential in the outbound segment… |

Currently, India ranks as the 2nd fastest growing outbound tourism market in the world, after China. It is estimated that India will account for 50 million outbound tourists by 20201. More importantly, the segment has undergone a transformative shift in recent times. About 5-7 years ago, the demand used to typically come from the metropolitan cities. Today, smaller towns (tier-2 and below) constitute around 40-45% of the overall demand. |

Millenials are avid travellers |

Similarly, in earlier times, travellers would typically belong to the age-group of mid-40s and above whereas currently, it is the millennials i.e., people in their late 20s and early 30s that comprise the majority of the outbound tourists. This is a largely a result of changing lifestyles within this age-group including the need for instant social media gratification. Outbound spending has been on a gradual rise, having doubled in the last 10 years from USD 7.5 billion in 2005 to nearly USD 16 billion in 2015. It is estimated to touch USD 19 billion by 20181. |

Upcoming growth drivers: Opportunities galore |

|

The rising stars… |

While the traditional tourism industry has been thriving, certain niche segments have also been growing rapidly. |

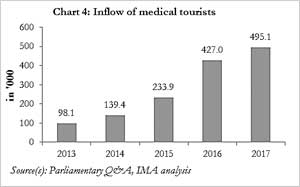

Medical tourism |

Growing at a staggering annual rate of 50% since 2013, medical tourism is regarded as the next jewel in India’s crown. The availability of skilled specialists at reasonable costs along with state-of-the-art infrastructure has enabled this surge. The inflow of medical tourists has grown five-fold from 98,146 in 2013 to 495,056 in 2017 (chart 4). Understandably, neighbouring countries (Bangladesh and Afghanistan) are the chief contributors (>50%) to this influx. At the same time, medical tourists from countries such as Iraq, Oman and Nigeria have also been witnessing a steady rise. Valued at USD 3 billion in 2015, the earnings from the medical tourism market has the potential to exceed USD 9 billion by 2020. |

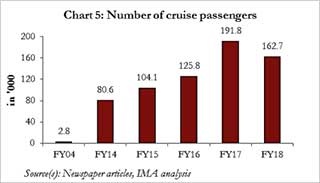

Cruise shipping |

The segment has the potential to create 250,000 jobs in the next 10 years and it is estimated that in the best-case scenario, the number of cruise passengers could rise to 4 million by 2042-43. However, issues such as high docking charges and levy of central taxes and duties could become roadblocks. |

Wildlife tourism |

Given India’s rich biodiversity, wildlife tourism is another area that presents vast scope. The segment, so far, has been popular only among domestic tourists. Foreign tourists are deterred by infrastructural challenges such as the significant distance of forests from the main cities and poor transport facilities. |

To conclude: Sustaining the momentum is the key |

|

Infrastructural gaps need to be closed… |

While the Indian tourism industry has been growing at a healthy pace, infrastructural gaps continue to persist. For instance, investment in the hotel industry needs to be amped up substantially. 85% of all hotels (1,410) in India are situated in just 10 states of the country. There is also a paucity of luxury hotels with only 472 of the total being four-star and above. Support from the government in the form of lowering taxes on real estate and enabling single-window clearance could provide the necessary impetus as investors often abstain from investing due to uncertainty regarding potential returns. Further, the success of schemes such as Bharatmala and UDAN could turn out to be a shot in the arm for the sector as tourists often refrain from travelling owing to poor connectivity and long travel times. |

… to reap the potential benefits |

The tourism industry is known to have several spill-over benefits. It was responsible for generating 8% of overall employment in India in 2017, including 37% indirect jobs1. Further, it is the third highest contributor of foreign exchange. Thus, it must be borne in mind that the sector is of immense strategic value with important economic implications. Therefore, while support of the government is essential for the sector’s growth, the private sector too will need to take active interest through infrastructure creation to reap the rewards of the industry’s growth potential. |

INSIGHT

In conversation with Jagdish Kumar, Group President and Group CFO, Anand Automotive Group

In conversation with Jagdish Kumar, Group President and Group CFO, Anand Automotive Group