COVER STORY

IMA India’s peer group programmes have long sought to lead thought on future trends in business through maximising the power of collective wisdom inherent in its membership. A key element of the same is the cross-fertilisation of experience and perspectives not just within the CFO Forum, but between the CFO Forum and IMA’s other peer networks; those for CEOs, CMOs and CHROs. Over 500 Heads of HR form IMA’s CHRO Forum as a foil to the 900-strong CFO member community. CFO partnership with Chief Executives at one end and HR at the other can yield a triad of performance that can be formidable. Equally, talent is the bulwark of transformative growth. Discussions within the CFO community have often yielded talent and productivity as core focus areas for CFOs for their own function as indeed for the organisation at large. This issue of CFO Connect centres on identifying new trends in talent and organisational structures at the onset of the digital century. This is based on the brainstorming between 90 members of IMA’s CHRO Forum, who came together in late May 2018 to focus on a host of issues that impact the length and breadth of every organisation, and especially the C-suite, in these times of disruption, and transformation.

CFO partnership with Chief Executives at one end and HR at the other can yield a triad of performance that can be formidable. Equally, talent is the bulwark of transformative growth

Digital disruption is now an inescapable reality that comes with its own challenges and opportunities. Critically, as Anish Shah, Mahindra & Mahindra’s Group President Strategy and Member of the Group Executive Board explained, it demands both mindset shifts, and strategic responses on an unprecedented scale. Leadership styles must also evolve with a shifting business environment, demanding new competencies, and stronger leadership pipelines. Equally, though, leadership at its core is about human values that remain perennial – even as their expression must change, as must the leader’s own ability to engage with teams and stand as exemplar, both internally and externally. Roundtable conversations led by EMA Partner Decision Dynamics, Quatrro Global Services, and Nestlé centred on these issues.

At another level, organisational structures must better align better with a workforce dominated by millennials, with fast-morphing supply chains, and with a rising ‘digital imperative’. Companies such as Tata Consultancy Services, RBS and JK Organisation are all approaching the issue in different ways, though with a common focus on agility, technology, innovation, and at the individual level, the promise of sustained growth.

Regardless of how external conditions change, entrepreneurship will remain a key driver of growth, particularly in the Indian context. Few companies embody this better than Makemytrip and its founder, Deep Kalra, who shared his boom-bust-boom journey and what it taught him about building a great entrepreneurial company.

Anish Shah,

Group President Strategy and Member of the Group Executive Board, Mahindra Group

The digital age is overwhelming in the scope of change it is engendering. That change is silent, and it is fast. It has overtaken how we live, and will transform how we work. This era coincides with transformative trends underway also in the geopolitical and regulatory domain. The hype around disruption is often focused on a few companies – typically Uber, Airbnb, and Amazon – whose business models and digital platforms are disrupting and reshaping industries. Yet today, every enterprise is (or at least should be) concerned about digital disruption. Moreover, for nearly everyone, including established, successful, and high-tech organisations, ‘digital transformation’ is about much more than just operational issues. Instead, it goes deep into the realm where systems, people and ‘things’ connect digitally. This pervasive approach to digitisation, in turn, opens up new strategic options and opportunities, and demands a call to action internally to create a winning edge for business, and perhaps, industry.

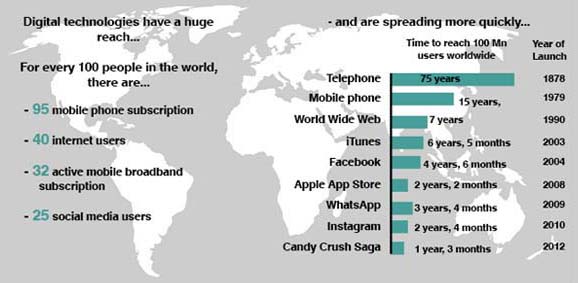

Today, the pace of disruption has increased dramatically, but it has not always been that way. It took the telephone 75 years to reach 100 million users worldwide, while Candy Crush, a popular online game, took less than a year to achieve that mark. Technology is at the forefront of this disruption, evident from the fact that today, the biggest firms (by market cap) are all technology companies. This stands in stark contrast to the situation just 20 years ago when, barring Microsoft, the majority of top companies were non-tech.

Navigating the digital landscape will mean creating adaptable organisations, building agile mindsets and ‘strategic optionality’, and – crucially – setting the tone from the top

With new technologies emerging all the time, the average lifespan of a company is shortening. A Yale University study finds that the average life span of companies in the S&P 500 index is just 18 years, and predicts that by 2027, a third or more of these firms will have ceased to exist. Just as striking, today, when a company like Amazon decides to enter a particular industry, the sector’s collective market cap instantly falls by 10-30 per cent. This suggests that both now and in the future, success will come to those who are flexible enough to leverage technology to engage with customers in deeper and more meaningful ways. As Mark Andressen observed, it is software platforms that will rule the world, so regardless of industry or size, every organisation must become a ‘technology company.’

Technologies that augment human intelligence are hugely expanding the scope for disruption. Saudi Arabia recently awarded citizenship to Sophia, a humanoid robot that leverages advanced machine learning and big data to self-learn and make decisions without human intervention. Such change is evident across industries and sectors. Financial services, for instance, are seeing the rise of ‘robo-advisors’, especially in the US, which provide automated, algorithm-driven financial planning services with higher accuracy, and at much lower fees. In the manufacturing space, emerging technologies like blockchain are enabling suppliers and manufacturers to enter into smart contracts that drive transaction efficiencies while enabling an unprecedented level of trust and transparency. M&M, for instance, leveraged blockchain to disrupt its supply chain financing, reducing its supplier bill-discounting time from seven days to seven seconds. The retail industry is seeing transformation in the grocery experience, with Amazon GO grocery stores allowing for checkout-free shopping via AI, deep learning, and computer vision. Smart speakers like Amazon Echo, Google Home and Apple’s Siri, now influences as much as 70 per cent of consumer purchase decisions. The growing adoption of technology in agriculture is enabling more accurate ‘precision farming’, allowing farmers to optimise the use of fertiliser and pesticides, and to predict their harvests on the basis of soil composition, weather, inputs, and similar parameters. Even tractors are getting transformed into fully autonomous machines that are capable of working on their own. In the auto sector, emerging technologies will have profound implications: Stanford professor Tony Seba claims that by 2030, 95 per cent of all vehicles will be electric, autonomous and shared.

To sustain long-term success in the current environment, disruption and innovation must be part of an organisation’s DNA. The key to success is changing the game internally – which itself rests on four broad drivers.

To successfully navigate disruption, companies must adapt their processes, operating models and systems. Too often, transformation efforts fall flat due to the problems that arise when silos – a legacy of command-and-control structures – fail to come together with a sense of ‘mission’. Successful firms develop cross-functional ways of sustaining outcomes. To stay relevant and ahead of the changes, M&M has built a ‘Centre for Emerging Technologies’ that brings together heads of business and internal experts, who collectively analyse emerging trends in technology and then frame appropriate action plans. M&M has also developed a ‘social media command centre’ – a dedicated central team centrally tracks emerging trends and potential threats, converting these into insights that are shared with business heads.

Success in digital transformation requires fresh mindsets, and finding an entirely new way of thinking and working: one that is built around curiosity, a willingness to celebrate failure (quickly moving on), and the ability to ‘break things’ wherever needed. Nurturing a culture of continuous change is critical, even if it questions every tested – and successful – business model. In the fullness of time, organisations will align to this approach internally, provided that vision is clear, and these behaviours are both reinforced by leadership and rewarded internally. Illustratively, M&M tested an AI-based automated marketing tool that proved to deliver better outcomes than humans. Despite initial resistance, the marketing team was quick to embrace the tool, knowing well that it may render a good part of its own team redundant.

To stay relevant in a rapidly-changing world, people are expected to constantly learn, unlearn and relearn. To achieve this, and to effectively lead digital transformation, leaders need to set the tone, both by constantly learning, and by embracing new technologies. They must also ensure that ‘digital’ is not restricted to a single department, but instead has a pervasive impact across the organisation by pushing employees – leadership included - to be digitally savvy. Interestingly, and almost counter-intuitively, this requires leaders to demonstrate empathy more than any other trait. Empathetic leadership will be able to guide teams through a time of intense change, just as it will be able to better recognise shifts in customer behaviour and preferences – a critical leadership trait necessary for success today and in the future. For HR, the task of harnessing this innate trait will be a mammoth task.

Over 3 billion people use Facebook; thousands take Harvard University courses online; the world uploads over 100 hours of video each minute; and 90 per cent of all data was created in just the last 2 years. The fundamentally must change just as fundamentally

Rapid change calls for swift action, and for that, it is critical to have a pipeline of options – a set of desirable, feasible and strategically-viable opportunities that are ready to be executed when the market calls for it. In turn, this requires a systematic workflow that evaluates and sorts through numerous opportunities that get identified within the scope of a given strategic intent. The objective is to have a ready list of options to be implemented with a high-level of predictability. M&M, for example, is betting on emerging scenarios in its auto business with Trringo – the tractor world’s equivalent of Uber. Similarly, M&M is ‘Uberising’ the commercial-vehicle rental space with Smart Shift, which connects SMEs with transporters, and taps into unused capacity, not only of M&M CVs, but those of its competitors, too.

Anuranjita Kumar,

Managing Director Human Resources International Hubs,

RBS

Shifting market dynamics in every industry from manufacturing to ITeS, are pushing companies to fundamentally re-think their organisational structures. Digital technologies are a prime driver: over 3 billion people are now on Facebook; more people take Harvard University courses online than on its campus; every minute, the world uploads over 100 hours of video on YouTube; and 90 per cent of the data that exists on the Internet was created in the last 2 years alone. Inevitably, with the online world changing so fast, the workplace must, too. The entrance of vast swathes of Gen-Yers to the workforce – they now make up as much as 85 per cent of TCS’ bench-strength of 396,000 – is another key factor. Yet, while taking advantage of today’s opportunities necessarily means creating future-ready workforces, the task is extremely complex. Firms like TCS, RBS and the JK Organisation, though, are doing just that. Few industries are more deeply impacted by technology than banks, but RBS is staying ahead of the game. Meanwhile, the JK Organisation is poised to almost double its top-line over the next years, to USD 8 billion, and TCS has just reached a major landmark, with its market-cap crossing USD 100 billion. In the years ahead, for these and other class-leading businesses, HR, in partnership with the CEO and CFO, will play a transformation role in breaking down hierarchies, driving cultural change, and enabling exponential growth.

Ritu Anand,

Senior Vice President and Deputy Head – Global Human Resources,

TCS

IMA’s CHRO Forum members have repeatedly called out the need to ingrain agility and innovation in the business. Investments in the latter will demand a comfort with failure, and the need to run multiple pilot projects that bring together diverse teams including crucially, from finance. Agility is perhaps even more fundamental as business cycles shorten and volatility continues. Technology obsolescence will lend itself to this need for agility because ways of working will also continue to evolve as technology becomes the bedrock of organisations regardless of sector.

Thiru A Thirunavukkarasu,

President Corporate Human Resources, JK Organisation

For CFOs, this need for agility will demand a fresh approach to both organisational structures and investments because BAU scenarios will be fast paced in terms of change. HR is the optimal partner and it is incumbent on both CXOs to come together to imagine the future and then crucially, act on it.

Organisations of the future will, most of all, be hugely dispersed – the use of external experts and specialists will increase, and demand a re-think of not just entry but exit strategies, as well as compensation modules. Team capability to accept ‘external yet internal’ inputs will have to be expanded and rewards structured accordingly. Tomorrow’s organisations will access specialist talent from the world over; global firms will in any event bring together multi-purpose and multi-functional teams for long-term initiatives but equally also for shorter-term projects that will be the hubs of innovation. For HR, this reality needs deep thought on how to create a commonality of culture; for Finance, the re-think is in the area of culture but also of accountability. In the case of both, flexibility of mindset is key, because flexibility is going to be the mantra – of operations, or organisations.

CFO and CHRO thinking on strategy and alignment on it is also most important because from that must flow the organisational structures of the future. CHRO need to socialise the changes they believe are necessary to create agile mindsets and flexible, nimble organisations will need CFO partnership and again, the onus is then on both.

Lastly, as leaders, ensuring organisational structures that enable a bottom-up bubbling up of ideas, and then prioritising that that energy is not wasted and the right ‘big’ ideas are acted on, is fundamental – to employee morale in the very least, and to the robustness of organisations to renew themselves periodically in line with a dynamic external reality.

Over the last 12-18 months, TCS has built a new talent framework around the needs of a changing workplace – one that rests on the assumption that talent, rather than being scarce, is abundant. The firm’s ‘digital re-imagination’ practice, which it offers to clients worldwide, takes a four-pronged view of how the workplace is changing. Its first element is the need for ‘continuous partial attention’ – which is really multi-tasking, but shaped around a digital context. The second part of the framework is the reality that knowledge, instead of being confined in a box, must be set free, sitting lightly across functions. In multiple situations today, people may not be formally qualified to perform a particular task, but thanks to cross-functional experience, they are doing it remarkably well. The third aspect is the ‘quantified self’ – which is a function of intrinsic motivation, and the ability to read and analyse the data around this. Finally, culture – especially the organisation’s ability to allow employees to play, decode, innovate, and implement – is a vital element of the changing workforce.

In line with this framework, TCS is building an end-to-end organisation where automation is to be embraced, not feared, and where jobs, instead of getting destroyed, will take on new hues. It is investing heavily in four related areas – technology infrastructure, platform tools, processes and governance – that are expected to yield exponential returns. By ‘shaking hands’ with technology, it is paving the way to a more secure future.

At the 120-year-old JK Organisation, HR is not just facilitating, but leading transformation. The wider organisation has long embraced sustainability – its paper business plants 80 million saplings a year, and the CSR initiatives run by its cement business have helped to virtually eradicate infant mortality in one district – as well as technology. The focus today is realigning systems and processes around technology, innovation, and agility. One way to do this is to involve younger employees, seeking their feedback, and converting that into insight and best practices. Each year, JK runs an internal conference that looks to capture learnings around a particular theme. One year, it was agility, the next year, sustainability and inclusive growth – something that matters greatly to manufacturing companies. 2017’s theme was ‘transformational change’, which brought middle management into the conversation around issues of innovation and agility. In parallel, JK runs top-management conferences every two years, bringing in outside experts to challenge deeply-held assumptions and beliefs. Senior managers in particular tend to suffer from ‘confirmation bias’ – the tendency to seek out opinions that validate rather than challenge one’s views – so it helps to hear the experiences of top global CEOs who have taken tough, courageous calls, like the head of a South African mining company who shut a mine over a single fatality.

A visible sign of change at the JK Group is its revamped competency-ranking model, which is centred on the same three keywords – technology, innovation, agility – and built on strong leadership at every level. From 12, the total number of measured competencies has been brought to 7, and focused around specific roles. Importantly, the ownership of career development has been moved from the immediate boss or business head to the individual. While managers will facilitate career growth, it is the employee who will take end-responsibility for it. At another level, there is a strong effort to infuse fresh talent at the highest levels. ‘Cultural fit’ is something that matters for the vast majority of roles, but for the critical 10 per cent of roles at the top, it is sometimes better to bring in ‘change champions’ who will disrupt the culture by design. In bringing in new people, JK now allows the job descriptions themselves to morph and evolve as it meets and short-lists candidates.

RBS’ engagement models work to ensure continuous growth, which in today’s flatter organisations is mainly about acquiring new skills and experiences. Horizontal rather than vertical growth is the key to achieving this

A mix of AI and robotics at one end, and the fact of multi-generational workforces at the other, means that today’s organisational structures face severe challenges in terms of being able to offer both career growth and employee engagement. With younger customers performing most of their transactions online, banks like RBS are scaling down their branches and using chat bots more intensively. Millennial aspirations in workforces however, remain the same – many aim to reach the C-suite by their late 20s. Engagement models thus need to shift, those centred on ensuring a realistic picture to employees of what is needed to ‘get there’, but also, to ensure continuous growth, which, in today’s flatter organisations, is mainly about acquiring new skills and experiences. Horizontal rather than vertical growth – which is mainly about job titles – is the key to achieving this. Yet, while technology can be an important enabler, it should not be seen as a ‘headcount reducer’. Further, the human element – having a person at the other end who understands the feelings and emotions of someone struggling with career progression – has to remain central.

In driving horizontal growth, today’s performance management systems often fall short, because they tend to box people in, and are sometimes too rigid about the competencies they measure. Making the process more ‘bespoke’ would help hone individuals’ strengths instead of moulding them into roles in which they may be sub-optimal. What is critical is to build a safe environment that allows people to experiment, without their mistakes coming back to haunt them. Taking bets on people, and believing in their potential rather than judging them by past potential, is a big element.

Across industries, the hierarchical structures of old are breaking down. Increasingly, teams come together for short stints, work on a certain project, and then disband when the job is done. Companies like TCS are becoming adept at forming short-lived ‘clans’ or ‘tribes’ (other firms prefer the word ‘squads’), which are centred around a single ‘coach’. Plainly, collaboration is the way forward, and in time, these will nullify some of today’s reporting structures. In some companies, HR may even merge with the business: TCS is already moving in this direction, while at Metso, it is integral to customer meetings. In place of specialists, there will also be a push to hire generalists who are capable of doing everything, say, from writing software to managing people and going out and selling the product. (That said, there will also be room for specialists with key skills, to come in for short stints, earning massive pay-outs for their work.)

In the midst of all this change, there will doubtless be some resistance because, at some level, employees seek hierarchy, authority, and clear-cut accountability.

At another end, change will also see continuity. While continuing to offer younger top performers outsized pay for example, many businesses will also continue to offer the perks and benefits that go with ‘seniority’. Many products and services, meanwhile, will live on for years after the ‘tribe’ that worked on them has disbanded. This makes it important to assign rewards and penalties with such outcomes – creating win-wins for everyone involved.

Raj Bowen,

Managing Partner, EMA, Partner Decision Dynamics

Fast-paced change at one level, accelerating expectations of teams at another, and most of all, the need to ensure bifocal vision on both the short-term and the long-term, has defined the operating space for industry leaders. Today, this is overlaid by the need to review leadership and its avatar anew, because the future itself is here faster than expected, because change is on so many planes that it can lead growth rather than be moulded to advantage, as was possible in earlier growth eras. To enable this best – on the count of performance, governance, and crucially, a culture of engagement – companies must strengthening their talent pipelines by emphasising a varying set of capabilities.

Raj Dutta,

Co-Founder and Executive Director, Quatrro

Despite substantial investments in leadership development, organisations often lack the strong leadership benches they need to meet current and future needs. In today’s volatile and ambiguous business landscape, the leader’s role has become far more complex, given geographically dispersed teams, a wider span of control, varied stakeholder expectations, and rapidly-changing products, services and processes. These challenges are inherently difficult to navigate, but each requires different leadership capabilities, which can be distilled into ‘8 Cs’:

On top of all of this, effective leaders usually possess such traits as being adaptable to change, the ability to take risks and make swift decisions, and being a good ‘follower’ of systems, process, and, where needed, other people.

Suresh Narayanan,

Chairman and Managing Director, Nestlé

Many firms worry that the current pace of change far outpaces the time it takes to develop key leadership skills, leaving many of today’s leaders ill-equipped to manage the external environment. Their concern is mainly around the rapidly-changing context in which companies operate, where success hinges on a whole new set of capabilities. Harnessing leadership attributes to drive success is no longer a choice for companies that aspire to ‘make it big’ in this high-potential, but also high-risk new world. For CFOs, this must be a key area of focus from the perspective of risk mitigation. To improve their leadership bench strength, organisations must look afresh at their leadership strategy, such as by:

Building a strong leadership pipeline requires a constant assessment of leadership needs, identifying potential leaders early on, including succession planning as a formal objective in KRAs, and embracing a culture of continuous L&D

Deep Kalra,

Founder and Group Chief Executive Officer, Makemytrip.com

In the long march of history, India will be known for its entrepreneurs across eras. Indian industry has developed models of excellence unaided by protection, and risen to identify avenues of opportunity that have enabled it to gain prominence globally and to create huge markets within India. Today, India’s entrepreneurs across sectors are creating value in segments large, medium and small. Whether they will go on to create legacies not just of medium-term scale, but of lasting institutions and sharply differentiated and impactful cultures, remain to be seen. The fact is that entrepreneurial spirit can be a country differentiator, and it is a business differentiator: Professionally run or otherwise, successful firms have at their core this unique spirit – to create, innovate, to gain responsibly, individually and collectively. One of India’s most successful new-age entrepreneurs shared his story, with recommendations for would-be entrepreneurs and CXOs in general.

Fresh out of IIM-A, Mr Kalra joined ABN Amro Bank, where he worked for three years. He then moved on to AMF Bowling, which taught him the nitty-gritties of running and setting up a business from scratch. However, he began to feel his learning curve plateauing, especially compared to his peers, and after four years at AMF, he decided to look for new opportunities. In 1999, a time when new opportunities were coming up, critically in the Internet space, he received a lucrative offer from GE Capital as VP Business Development for its retail business. Working with the brightest people in the industry, and some of the top players in the Indian Internet space, Mr Kalra spent a little over a year at GE. Soon enough, his intrapreneurial stint at AMF stirred in him a need to strike out on his own. Around that time, he met Internet entrepreneurs like Sanjeev Bikhchandani and Ajit Balakrishnan, and decided to start his own venture – and Makemytrip (MMT) was born on April Fool’s Day, 2000.

After 3 years at ABN Amro, 4 years at AMF Bowling, and a short stint at GE Capital, Deep Kalra felt the need to strike out on his own, in the then-nascent Internet space

Just months after its launch, MMT was staring down the barrel of a gun. The dot-com bust had sent the Internet industry into a tailspin, and 9/11 made things even worse. Venture capital investor eVentures, which had funneled USD 2 million into MMT at inception, demanded its money back. This came as a huge shock, because MMT was performing well on every front. Eventually, Mr Kalra managed to find angel investors, and pooled in his personal savings to buy back eVentures’ 70 per cent stake. The next two cash-strapped years were some of the most difficult, yet exciting times for the company. By and by, MMT went on to solve important problems for the travelling consumer in the most creative manner, emerging as a highly trusted brand. It has not looked back since.

Taking cues from Amazon’s CEO, Jeff Bezos, MMT has banned the use of PowerPoint presentations at meetings. Instead, executives must write 2-6 page-long, evidence-based memos to communicate their thoughts. The very act of structuring a document, built around complete sentences and paragraphs, forces deeper clarity than simply reading off a deck of PPT slides. Memos are always printed (not emailed), and placed in front of participants at the meeting, who are given 20 minutes to go through the document before deep-diving into a discussion. This process enables a stringent focus on execution, especially in a VUCA world where strategies become redundant all too frequently.

For MMT, the two fundamental metrics of success are acquiring customers quickly at a lower cost, and ensuring that they keep coming back (i.e., the repeat rate). The company’s aim is to acquire new customers not by offering discounts and cashbacks, but by creating a strong brand that genuinely cares. This is enabled on the back of a strong culture of problem-solving. To achieve this, MMT leverages the ‘5 Whys’ technique, which involves asking the question ‘why’ five times, thus peeling away the layers of any ‘symptoms’ and arriving at the real issues.

Entrepreneurs that surround themselves with less-smart people tend to stunt their business’ growth. Attracting quality talent requires branding your company as a career destination that offers great learning, as well as growth opportunities going beyond just a lucrative pay package.

MMT’s culture promotes high-performance, and emphasises risk-taking. Employees are encouraged to innovate, such as by running experiments without the fear of blame or repercussions if they fail. As with any major cultural shift, this had to flow from the top, with leaders setting the example by taking ownership for failures, and shifting the focus from assigning blame to developing an improvement plan.

Building a true meritocracy requires having a performance management system that emphasises the ‘right’ behaviours and outcomes, and having leaders lead by example

To succeed in a complex environment, organisations must foster meritocracies by hiring, rewarding and promoting people based on their performance, behaviours, skills and abilities. To put this into action, the performance management system should emphasise the ‘right’ behaviours and outcomes, and leaders must lead by example. Critically, when rewarding people, promotions alone do not help; instead, people should be directed to a path that enables them to follow their passions. This is even more important for people who have become ‘saturated’ at their current levels. Leadership involvement, therefore, is key in terms of providing timely guidance. MMT’s culture of meritocracy is a good case in point. It promotes role model behaviour, such as, recently, by recognising 40 staff members at its annual town-hall who started out at the bottom, without great pedigrees, but have reached the top positions. It also drives learning by observing (HIPOs are given regular facetime with CXOs); rewards performance (70 per cent of MMT staff own company stock); provides latitude for people to pursue their passions; and it keep politics under check.

At most public companies, there is strong pressure to deliver strong quarterly results, meet targets and surpass estimates. Organisations sometimes go to any length to meet or beat the consensus estimates, even at the cost of the business’ longer-term health. Successful companies, though, effectively manage these expectations without compromising on the broader goals. The tone at the top plays a crucial role in this – and the leadership must ensure that short-term performance pressures get contained and do not trickle down. This is evident at MMT, where quarterly results do not have a bearing on the bigger punts: solving customer problems innovatively, and building a great company. Since MMT’s listing in 2010, it has been battered in 8 out of 29 quarters, yet it has managed to retain its focus on the larger game plan. Today, its market cap stands at USD 3.5 billion up 7x from USD 0.5 billion in 2010.

While organic growth is to be preferred, sometimes, inorganic growth is the only option. Organisations that are able to crack the ‘M&A code’ achieve greater synergies on multiple fronts: people, processes, systems, technology, and customers. Typically, though, just one in five companies succeeds at M&A, mainly on account of people-related challenges. The MMT-Ibibo merger, for instance, had more than its fair share of integration challenges, especially related to people issues. However, these were eventually resolved.

--------------------

This article is based on discussions at IMA India’s 2018 CHRO Roundtable, held in Gurgaon in May 2018.