ON YOUR MIND

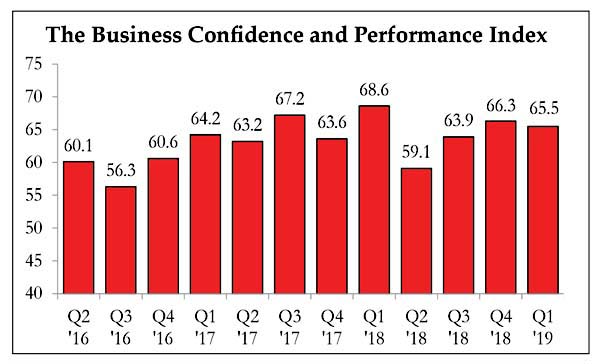

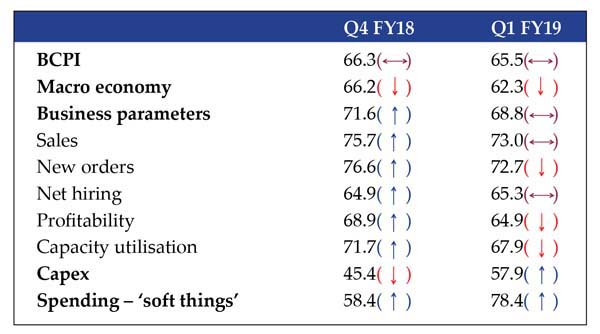

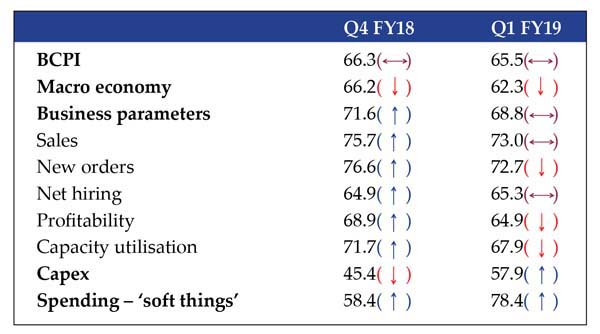

After falling to a 7-quarter low of 59.1 in mid-2017, IMA’s bellwether quarterly business confidence and performance index (BCPI) is back up to a respectable 65.5, though down mildly (~80 basis points) from its quarter-ago level. With over 280 companies responding to our end-May/early-June survey, these results not only capture on-ground performance for the bulk of the present quarter, but also reflect a gently improving macro-economy (7.7 per cent growth in Q4) and expectations of a normal monsoon. Revenue and net-profit growth are both forecast to strengthen in the financial year as a whole, but weaknesses persist on other business-performance parameters, including profitability and capacity utilisation. At the same time, the macro-economy outlook has softened in recent months, albeit staying solidly in the expansionary zone.

On the flip side, critically, capital investments may be finally reaching ‘escape velocity’, while ‘soft spends’ – and most strikingly, travel budgets – appear to be moving up decisively. These two indicators alone may point to an economy that is now firmly in revival mode, though with big cross-sectoral variations.

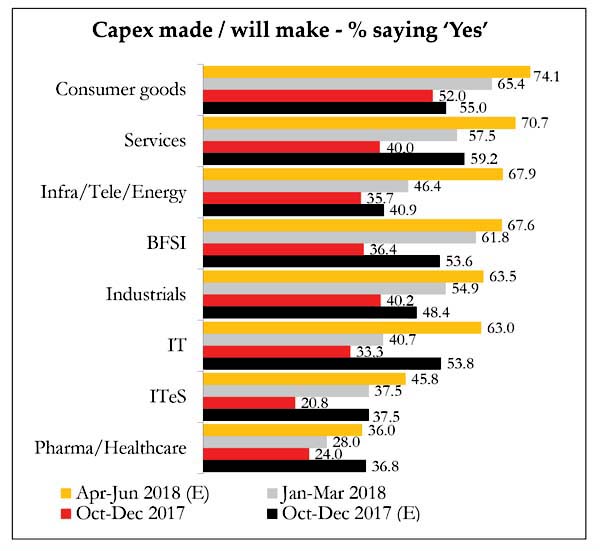

The start of a new financial year comes with a certain optimism around capital spending, and this year is no different. Like in early FY18, over 60 per cent of companies expect to make or sign off on new investments this quarter. In itself, this is unremarkable, and in fact, actual investments in the year-ago quarter were deeply disappointing.

Two factors, however, suggest that ‘this time may be different’: first, the timing of the survey, late in Q1, means that it is likely to more closely track actual decision-making; and second, the CapEx index number (57.9) stands at a multi-year high, just exceeding the year-ago level (57), but head-and-shoulders above the recessionary figures seen in recent quarters.

Although still some distance below the ~65 levels seen in the early 2010s, what makes this especially credible is that, in 6 of 8 sectoral grouping, 63-74 per cent of companies expect to sign off on new capital spends this quarter, up strongly from January-March. Consumer Goods and Services firms are the most bullish, while at the other end, IT and Pharma/Healthcare firms are dragging down what would otherwise have been even more robust headline numbers.

For industry as a whole, and almost uniformly across sectors, top- and bottom-line growth is forecast to edge up this year. At the median, revenue growth is expected to come in at 10-15 per cent, the same as last year. Notably, though, far more firms (65 per cent) believe they will do better than 10 per cent, compared to the 53 per cent who beat that level in FY18. (37 per cent expect 15 per cent growth or more.)(Barring a bullish BFSI sector, which forecasts 20-25 per cent top-line growth, every sector has either stayed in or moved up to the 10-15 per cent range.

Meanwhile, net profit growth is thought to move up from the 5-10 per cent band to just above 10 per cent at the median, with a majority of companies (52 per cent, up from 43 per cent) expecting 10 per cent or more, and over 30 per cent believe they will cross 15 per cent.

--------------------

IMA Research for CFO Connect